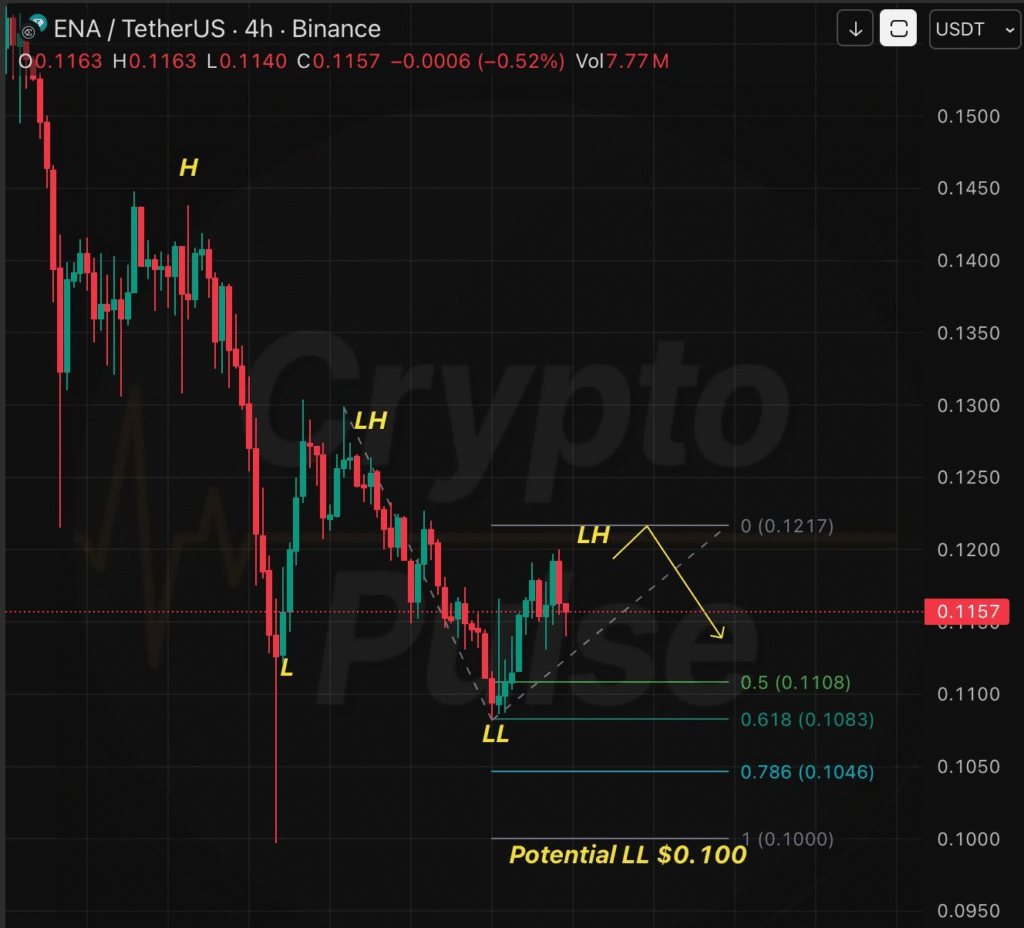

- $ENA continues its downtrend, with lower highs and lower lows forming.

- Fibonacci extension predicts $ENA’s next potential low near $0.100.

- A close above $0.13 would invalidate the bearish downtrend for $ENA.

ENA is showing a continued downtrend, as indicated by the formation of lower highs (LH) and lower lows (LL). The price movement suggests a potential further decline, with technical analysis pointing to a key support level around $0.100. Traders are closely watching for signs of a reversal or continuation of this bearish trend, with the invalidation level marked at $0.13.

$ENA Continues Downtrend with Lower Highs and Lower Lows

$ENA is currently in a downtrend, marked by consistent formation of lower highs (LH) and lower lows (LL) on the chart. According to CryptoPulse, this indicates that the price action is following a bearish pattern, with little sign of reversal in the short term. Traders have been observing this pattern closely as it continues to show signs of further downside potential.

The next potential lower low (LL) for $ENA is identified using Fibonacci extension levels. The technical analysis points to a price target near $0.100, suggesting that the price may continue to decline towards this level. This prediction remains valid unless $ENA reverses the pattern and breaks above key resistance.

Key Resistance and Invalidation Point for $ENA

The critical invalidation level for the $ENA downtrend is at $0.13. If $ENA manages to break this level and closes above it, the bearish pattern could be invalidated. This would suggest that the asset has entered a new bullish phase, and the current downtrend may end. However, until this level is broken, the downward pressure remains a concern for traders who are currently monitoring $ENA’s movement closely.

In the meantime, $ENA’s price continues to trade within a tight range, and its future movement is contingent on breaking either the resistance or support levels. The Fibonacci extension level at $0.100 remains the key price target for now, signaling the next major support level.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.