Ethereum is flashing one of its most reliable historical signals for major rallies: exchange supply is plunging to new lows while price action remains relatively flat. For seasoned market watchers, this setup has repeatedly preceded explosive breakouts, and many believe the next move could send ETH into uncharted territory.

Meanwhile, retail traders are not just watching Ethereum’s supply dynamics—they’re also piling into emerging projects. MAGACOIN FINANCE, which has already completed full HashEx and CertiK audits, is being hailed as the number one presale of 2025, attracting massive demand from early investors.

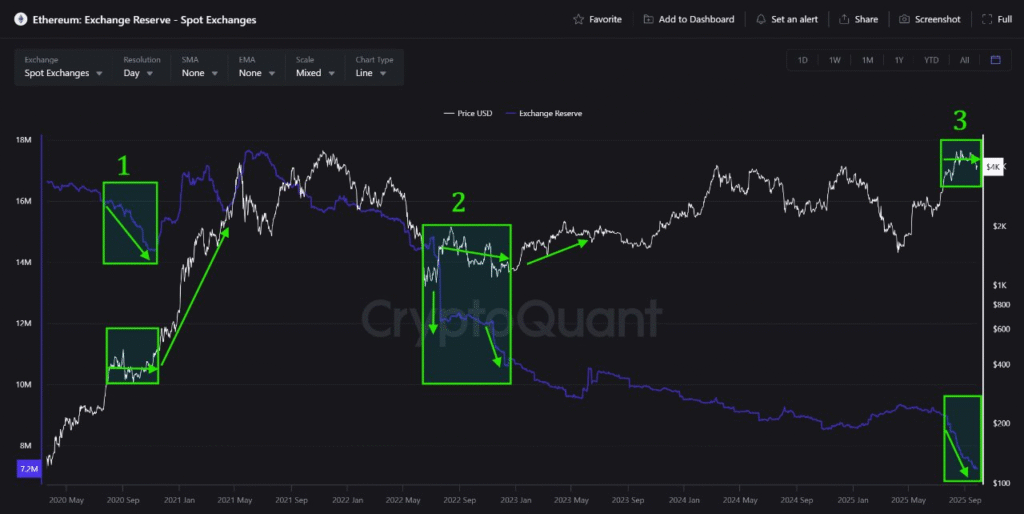

Ethereum Exchange Reserves Hit Record Lows

Fresh data from CryptoQuant highlights a third historic phase of exchange outflows for Ethereum. In previous cycles, similar supply drains have directly preceded dramatic rallies.

- Phase One (2020–2021): ETH reserves dropped from 16 million to 10 million, even as the price stayed muted around $400. Once demand spiked with catalysts like macro easing and DeFi’s rise, Ethereum surged nearly 12x, reaching $4,800.

- Phase Two (2022–2023): After FTX’s collapse, ETH reserves slid again, from 15 million to 9 million. During this time, price stagnated near $1,100. But once liquidity returned, ETH rallied nearly 4x to $4,000.

Phase Three (Now): Reserves are sitting at **9.2 million ETH—historic lows—**while price consolidates near $1,900–$2,000.

This persistent outflow suggests that long-term holders and institutions are accumulating ETH while keeping it off exchanges. The mechanics resemble a bathtub draining: the water level (price) looks stable, but outflows continue beneath the surface. Eventually, when selling dries up, even a modest increase in demand can push prices sharply higher.

Why This Signal Matters

Exchange supply reflects how much ETH is readily available for trading. Lower balances mean fewer coins can be easily sold, tightening liquidity. If new demand emerges—through ETF approvals, institutional adoption, or macro easing—the imbalance between supply and demand could ignite a violent upward move.

Analysts argue that ETH’s current consolidation cannot last indefinitely. Once sellers are exhausted, Ethereum could follow the same explosive path seen in prior cycles. On-chain researcher Ali notes that ETH’s supply squeeze has historically preceded massive runs, making this one of the most closely watched indicators in the market today.

Retail’s Number One Presale of 2025

While Ethereum’s supply squeeze sets the stage for a potential institutional-driven rally, retail traders are focusing on a very different opportunity. MAGACOIN FINANCE has been breaking records in presale fundraising, already surpassing $15.5 million. What has really boosted investor confidence is its successful completion of full HashEx and CertiK audits, rare for early-stage projects.

This combination of strong demand and proven security has put MAGACOIN FINANCE at the top of retail watchlists. Analysts project that early investors could see massive upside once listings go live, with some estimates suggesting returns of up to 55x.

For comparison, Ethereum and Cardano delivered life-changing gains to early adopters, but such exponential upside is much harder to achieve once projects reach multi-billion-dollar valuations. MAGACOIN FINANCE, still in its infancy, offers that same early-entry allure. It’s this mix of scarcity, hype, and security validation that makes it the standout presale of 2025.

Potential Catalysts for Ethereum’s Breakout

Several upcoming events could provide the demand surge ETH needs to capitalize on its supply shortage:

- Central Bank Policy: With global growth slowing, rate cuts appear increasingly likely in late 2025. Cheaper liquidity has historically been rocket fuel for crypto markets.

- Institutional Adoption: From asset managers preparing ETH-based ETFs to banks exploring staking services, institutional interest in Ethereum continues to expand.

- Ecosystem Growth: Ethereum Layer-2 networks are booming, bringing cheaper transactions and new waves of user activity to the ecosystem.

Together, these factors could combine to push ETH far beyond its $2,000 consolidation zone, potentially setting the stage for a retest of its $4,800 all-time high and beyond.

Different Paths, Same Momentum

The contrast between Ethereum and MAGACOIN FINANCE shows two sides of today’s crypto market. Ethereum offers institutional credibility, historic reliability, and the potential for another massive rally triggered by structural supply shortages. MAGACOIN FINANCE offers speculative, retail-driven momentum with the possibility of explosive early returns.

Both approaches appeal to different types of investors: Ethereum for those seeking long-term exposure to a cornerstone asset, and MAGACOIN for those looking to capture the excitement of the next breakout altcoin. Together, they represent the balance investors often seek between stability and high-risk, high-reward opportunities.

Conclusion

Ethereum’s supply is at record lows, a setup that has repeatedly preceded massive rallies in past cycles. With global liquidity improving and institutional demand on the rise, ETH may be on the verge of another historic breakout.

At the same time, MAGACOIN FINANCE is capturing retail attention like no other presale this year, backed by full HashEx and CertiK audits and projections of up to 55x returns. For investors, the message is clear: the market is offering both a proven giant poised for a rally and a new challenger that could redefine early-stage success in 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto Newz does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decision