- TD Sequential shows sell signals on Ethena’s $ENA, suggesting bearish trend.

- Arthur Hayes accumulates $995K worth of $ENA tokens, raising his holdings.

- Ethena pulls back from USDH stablecoin bid after community feedback.

Ethena Labs has withdrawn its proposal to issue Hyperliquid’s USDH stablecoin, citing concerns raised by community members and validators. This move comes after a series of discussions with stakeholders about Ethena’s position in the ecosystem.

Founder Guy Young confirmed the decision in a post on X on September 11, acknowledging the community’s reservations. The feedback pointed to three key concerns: Ethena’s non-native connection to Hyperliquid, its involvement in multiple products beyond USDH and its broader ambitions, which extend beyond a single exchange partnership.

Ethena decided to step aside rather than contest these points. Young noted that the decision to withdraw was taken in response to these concerns, signaling that the team respects the community’s viewpoint.

Bearish Technical Signals for $ENA

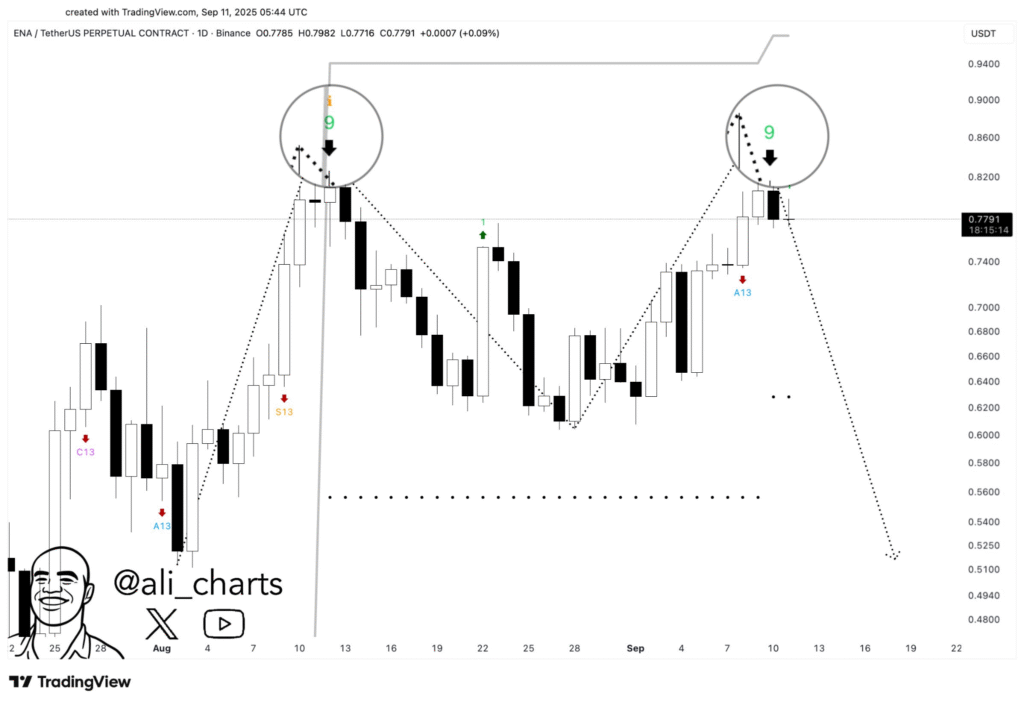

The $ENA token, the native asset of Ethena, has shown bearish signs according to technical analysis. The TD Sequential indicator, which tracks price momentum, has signaled “sell” at both of the recent peaks. This has prompted concerns about a possible double-top pattern on the chart, a common signal for a trend reversal.

A price correction followed the first peak, and the second peak is now showing similar signs of weakness. If this bearish pattern is confirmed, the price of $ENA could experience a significant retracement, with analysts suggesting a target of around $0.52.

This would mark a notable decline from the current levels of approximately $0.77, intensifying the downside risk for traders monitoring the token’s short-term price movements.

Arthur Hayes Expands $ENA Holdings Amid Market Volatility

Arthur Hayes, the former CEO of BitMEX, has continued to accumulate $ENA tokens. Hayes recently added 578,956 tokens to his holdings, valued at approximately $473,000. This brings his total investment in $ENA to nearly $1 million, with a current estimated value of $3.91 million.

Hayes’ accumulation strategy follows a pattern, with significant purchases from platforms like Binance, Galaxy Digital, and Wintermute. His investment comes amid Ethena’s attempts to issue USDH and the broader uncertainty surrounding the token’s market direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.