- Ethena is consolidating around $0.40–$0.45, a critical support zone that underpins stability and potential breakout momentum.

- Projections suggest ENA’s market cap could expand from $3B to $30B if support holds and adoption strengthens.

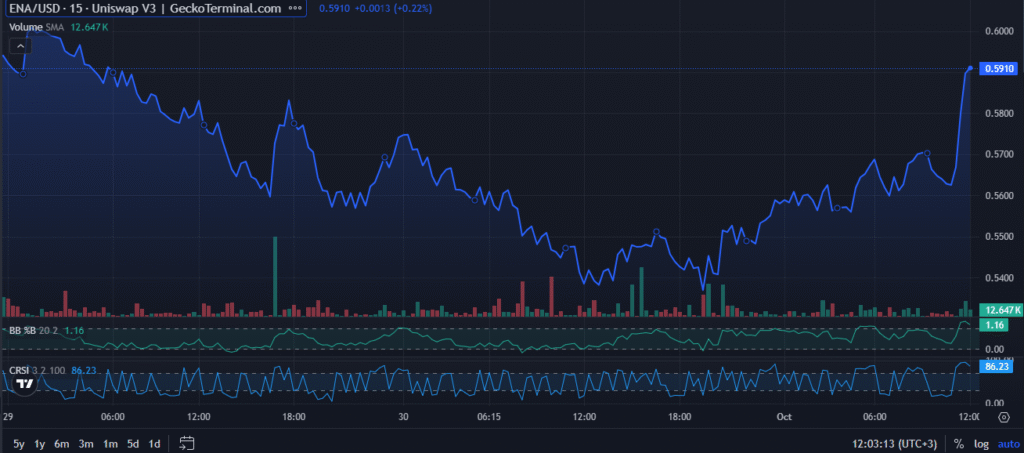

- With ENA trading near $0.5910 and testing $0.60 resistance, overbought signals hint at near-term consolidation.

Ethena is showing signs of strength as the token builds stability around a support range between $0.40 and $0.45. This level has proven resilient with repeated rebounds highlighting strong market engagement. The zone now represents a critical foundation for momentum.

The current structure shows consolidation with lower highs forming against a descending trendline. However, accumulation within the buy zone reflects confidence in future growth. Maintaining this base would establish a platform for any sustained upward movement.

Breaking beyond the resistance trendline could reshape sentiment significantly. The combination of strong support and tightening resistance highlights the importance of this technical zone. Therefore, holding this range remains key for progress.

Growth Projection

Ethena has potential for substantial expansion if support remains intact. Market projections suggest its capitalization could rise from $3 billion to $30 billion. This increase would reflect both structural positioning and adoption strength.

Source: Coingecko

Higher long-term targets show optimism beyond present trading levels. These expectations are supported by scalability prospects and ecosystem development. Yet, progress will rely on consistent defense of the support range.

Adoption trends and demand across markets will also influence growth. Continued engagement could create conditions for long-term expansion. Sustained activity remains necessary to achieve the projected targets.

Market Outlook

Recent sessions displayed volatility before a sharp upward move. Ethena traded at $0.5910 after rebounding strongly from earlier declines. Renewed buying activity created a short-term bullish signal.

Volume levels confirmed the rally as participation increased sharply. Technical indicators such as CRSI placed the token in overbought territory. This suggests consolidation could occur in the near term.

If momentum continues, Ethena may test resistance near $0.60. However, failure to hold demand could push the price back toward $0.56. Near-term outcomes will depend on continued buyer strength.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.