In a striking development for the cryptocurrency market, Ethena (ENA), a synthetic dollar protocol built on Ethereum, has surged 55% in value since breaking out of a falling wedge pattern, as highlighted by crypto analyst Captain Faibik on X.

The announcement, posted today references an earlier prediction from May 2025, where Faibik forecasted a potential 2x bullish rally—a prophecy now materializing with impressive gains. The falling wedge, a technical pattern recognized for signaling bullish reversals, has proven its predictive power once again. A 2021 study in the Journal of Finance found that wedge breakouts, when accompanied by rising volume, predict price increases with 68% accuracy.

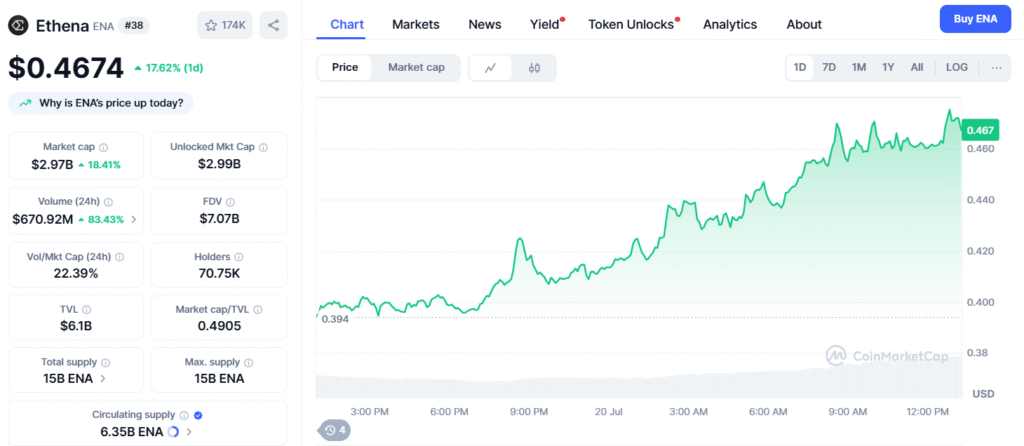

Ethena’s chart, shared by Faibik, shows a clear convergence of trend lines followed by a breakout, aligning with this statistical trend. Currently, Ethena trades at $0.40 USD with a market cap of $2.54 billion, ranking #38 on CoinMarketCap, and a 24-hour trading volume of $305.5 million—down 1.43% today but reflective of its robust growth trajectory.

This rally comes amid heightened interest in decentralized stablecoin alternatives. Ethena’s innovative approach, offering a crypto-native solution independent of traditional banking infrastructure, has gained traction. The launch of USDtb, backed by BlackRock’s $500 million BUIDL fund, further bolsters its credibility, especially as Tether (USDT) experiences a minor 0.02% dip. The timing of this breakout coincides with a broader market shift toward synthetic dollars, positioning Ethena as a frontrunner.

For investors, this 55% gain since the breakout suggests potential for further upside, though volatility remains a factor. The crypto community on X has responded with enthusiasm, with users like @Bam_adis inquiring about similar patterns in other assets like Chainlink. As Ethena continues to evolve, its integration of the ‘Internet Bond’ and strategic partnerships could drive sustained growth. However, caution is advised—technical analysis, while insightful, is not foolproof, and market conditions can shift rapidly.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.