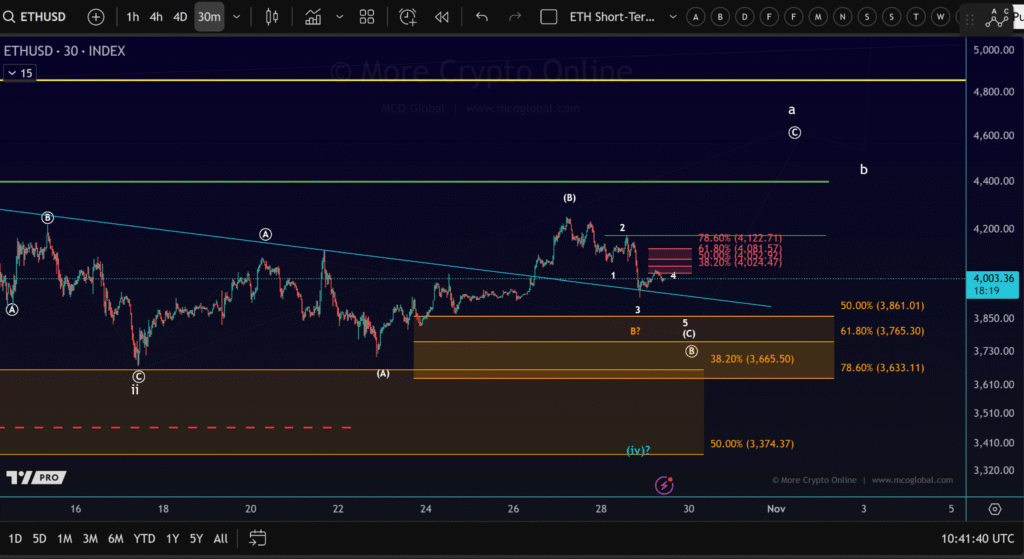

- Ethereum faces key resistance at $4,122 with a break above $4,400 signaling bullish momentum.

- Ethereum sees a 3% drop in 24 hours, while total liquidations exceed $155 million in 24 hours.

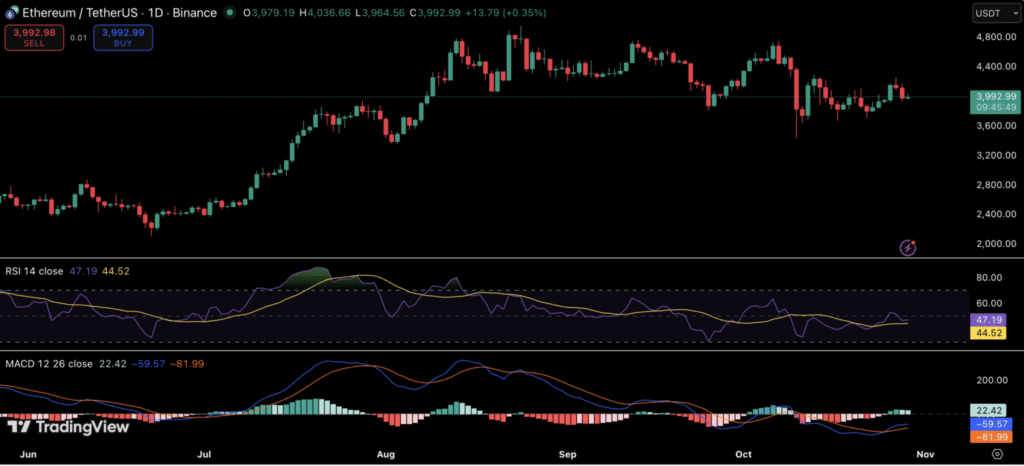

- RSI and MACD suggest potential for Ethereum’s recovery if support at $3,800 holds.

Ethereum ($ETH) has maintained a relatively stable position near $4,000 despite a 3% drop over the past 24 hours. As the cryptocurrency market braces for key events, traders are focusing on the U.S. Federal Reserve’s upcoming interest rate decision.

Ethereum’s current position, just below $4,000, places it within a critical price range. Traders are closely watching a resistance zone between $4,024 and $4,122.

A breakout above these levels could signal a shift toward the $4,400 mark, indicating bullish sentiment. The market’s attention is now split, with traders monitoring broader economic news, including the Federal Reserve’s interest rate decision.

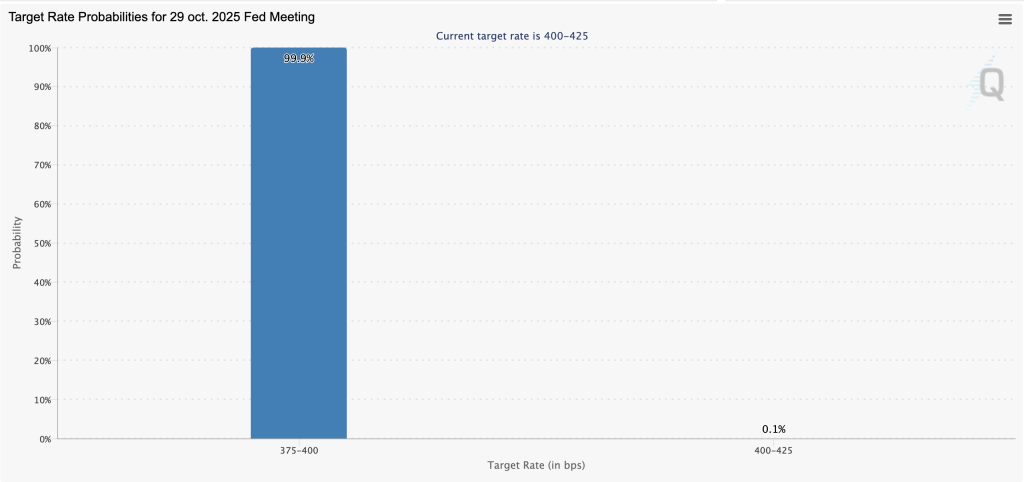

FOMC Interest Rate Decision Could Impact Ethereum’s Price Action

The Federal Open Market Committee (FOMC) is set to announce its decision on interest rates today. Economists suggest there is a 99.9% chance of a 25 basis point (bps) rate reduction.

If this occurs, some analysts expect it to provide a boost to Ethereum and other assets. However, uncertainty remains following President Donald Trump’s surprise decision to increase tariffs on Chinese goods, which could potentially complicate the Fed’s decision.

Although a rate cut appears likely, any change in the Fed’s course could significantly influence market behavior. If the Fed delays or reconsiders its decision, market volatility may increase.

Ethereum Sees Increased Volumes, But Market Remains Uneven

Ethereum’s trading volume has risen by 10%, now accounting for over 7% of the circulating supply. This indicates a growing level of market activity ahead of crucial events.

Despite the increased volume, the market remains uncertain about Ethereum’s next move, with traders closely observing the broader economic conditions and technical indicators.

Currently, the Relative Strength Index (RSI) stands at 47, indicating neutral momentum. The Moving Average Convergence Divergence (MACD) is showing slight positive movement, hinting at a potential bullish crossover.

Should Ethereum maintain its position near the support range of $3,800 to $3,850, a recovery toward $4,200 could be on the horizon. However, market dynamics will depend largely on external factors such as the Fed’s decision and global economic conditions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.