- Ethereum saw $546.9 million in inflows on Sept 29, led by Fidelity’s $202.2 million purchase.

- BlackRock, Bitwise, and Grayscale also contributed to the $546.9 million ETH inflow.

- Ethereum is hovering near a critical resistance at $4,300, signaling possible breakout.

Ethereum (ETH) has recently witnessed a significant influx of institutional investments, with $546.9 million flowing into the network on September 29, 2025. This surge in capital highlights increasing interest from traditional financial institutions, including prominent players such as Fidelity, BlackRock, and Grayscale. These movements come at a time when Ethereum’s price is testing a crucial resistance level of approximately $4,300.

Institutional Interest in Ethereum Rises

Meanwhile, Fidelity was the largest buyer, contributing $202.2 million to the Ethereum network. This transaction is part of a larger trend where institutions are increasingly positioning themselves in ETH, underscoring the growing role of cryptocurrency in mainstream finance.

BlackRock, Bitwise, and Grayscale also made substantial purchases, further reinforcing the bullish sentiment around Ethereum.

While smaller investors from firms such as VanEck and Invesco also participated, the aggregate investment represents a clear trend toward increased institutional involvement in Ethereum. This inflow aligns with a broader market trend, where institutional players are increasingly viewing ETH as a valuable asset for their portfolios.

Ethereum Nears $4,300 Resistance Point

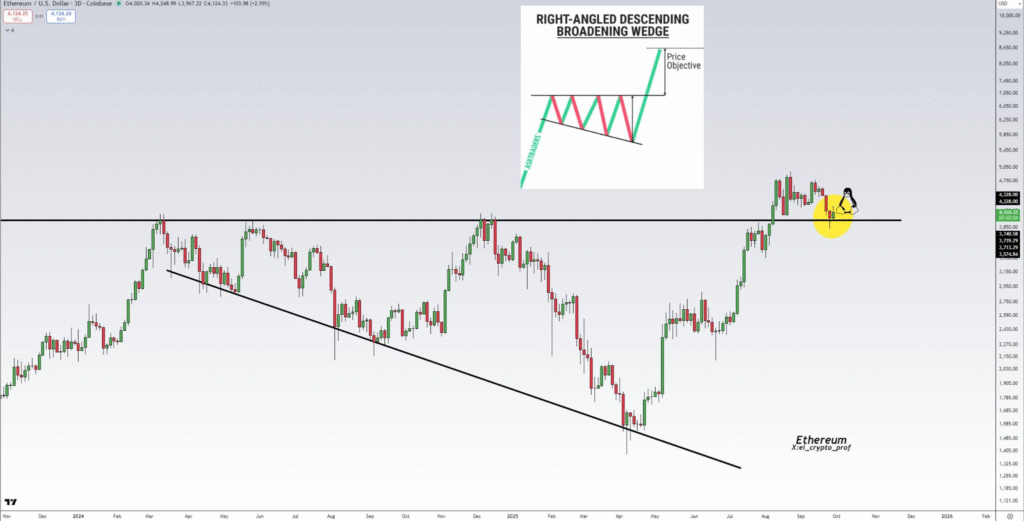

Ethereum’s price is currently hovering around $4,300, marking a critical resistance level. A breakout above this zone could pave the way for further gains, with some analysts predicting a potential price target of $10,000 to $12,000.

Ethereum’s technical chart is showing a Right-Angled Descending Broadening Wedge formation, which traditionally signals an impending breakout after a consolidation phase.

This price movement is viewed positively by many in the crypto community, as a breakout above $4,300 could catalyze additional upward momentum for Ethereum. As the altcoin season narrative begins to fade, Ethereum’s growth could lead the market, benefiting other cryptocurrencies in its wake. The broader altcoin market is likely to follow Ethereum’s movements, benefiting from its potential surge.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.