- Ethereum’s RSI crossover signals a potential mid-term correction.

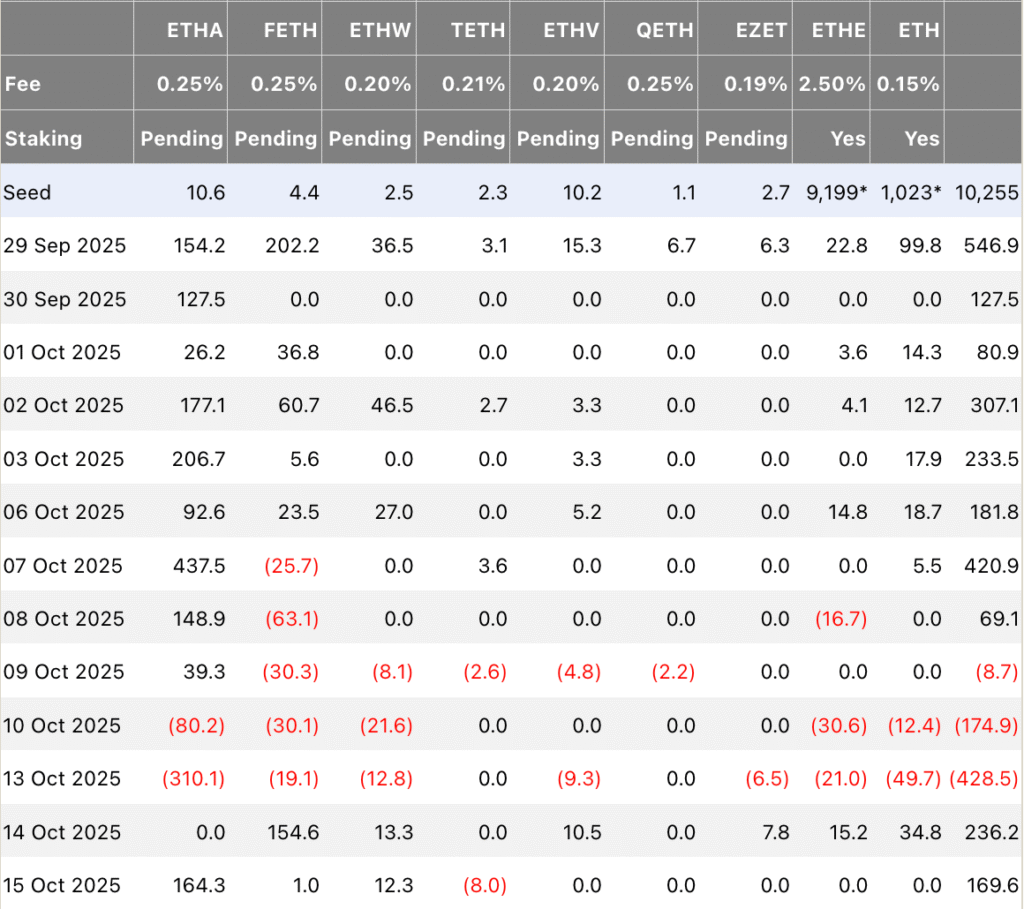

- Over $2B flowed into ETH ETFs between September 29 and October 8.

- Key support levels sit at $3,500 and $2,500 amid market uncertainty.

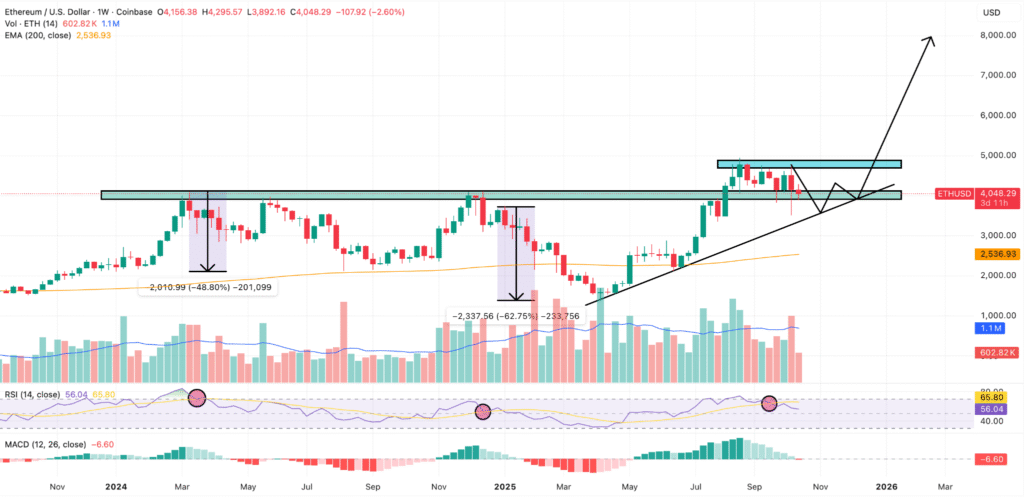

Ethereum (ETH) has experienced a 10% decline over the past month, struggling to sustain momentum after reaching new highs. Data from TradingView, shared by analyst Michaël van de Poppe, shows Ethereum retesting a former resistance zone that may serve as a key support.

Despite renewed investor optimism, technical signals suggest the possibility of a deeper pullback before the next major rally.

Between late September and early October, ETH-linked exchange-traded funds (ETFs) recorded nearly $2 billion in inflows, reflecting renewed institutional interest. Following a brief period of negative net inflows, an additional $400 million has entered the market in recent days.

However, the positive capital movement has not yet translated into sustained price recovery, as Ethereum continues to face downward pressure near the $4,100 zone.

RSI Crossover Signals Downtrend Toward $2,500

Ethereum’s weekly Relative Strength Index (RSI) has dropped below its 14-day exponential moving average (EMA), signaling a potential sell opportunity that has preceded large corrections in the past. Historically, similar patterns have led to price declines of 49% and 63% following peaks around $4,100.

If this pattern repeats, ETH could see its price fall toward $2,500 representing a potential 37.5% downside from current levels. Analysts note that the 200-day EMA remains a key level to monitor, as it has served as support during previous corrections.

Key Support Zones and Market Outlook

Despite the bearish indicators, Ethereum maintains a strong support trend line near $3,500. This level could act as a cushion if selling pressure continues, reducing potential losses to around 12.5%. The broader market remains uncertain, though ETF inflows and steady trading volumes suggest ongoing investor confidence.

While Van de Poppe anticipates a possible new bullish leg for Ethereum within one to two weeks, short-term volatility remains likely. The coming sessions may determine whether Ethereum consolidates above key support or extends its correction phase before resuming its upward trend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.