- Ethereum exchange balances dropped to 14.8M ETH, reducing liquidity and tightening available supply.

- Declining reserves amplify sensitivity to demand, creating conditions for potential upward volatility and price rallies.

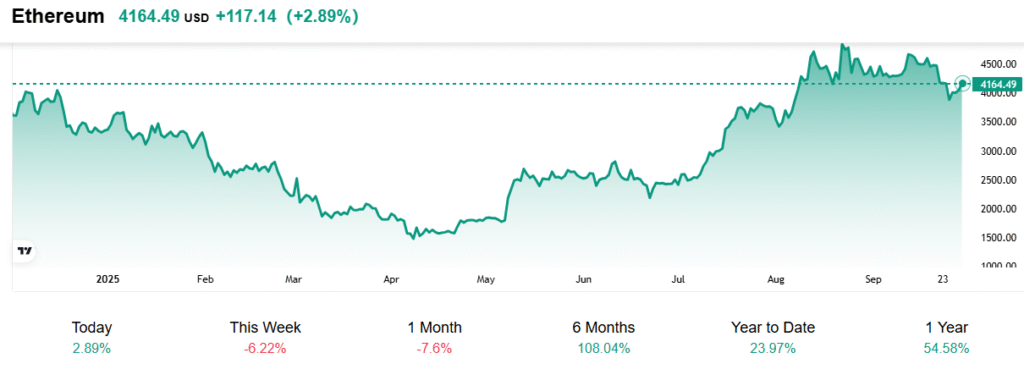

- Despite short-term dips, Ethereum has gained 108% in six months and 54.58% in one year.

Ethereum exchange reserves have fallen sharply, reaching 14.8 million ETH, the lowest level since 2016. This decline indicates reduced liquidity, meaning fewer tokens are available for immediate selling. Such conditions often create upward pressure, as supply constraints amplify even modest demand.

The reduced balance reflects a growing trend of withdrawals toward cold storage and decentralized platforms. This behavior typically signals strong conviction among holders who intend to keep assets for the long term. As reserves shrink, markets often adjust to reflect tightening supply conditions.

Historically, similar supply contractions have preceded strong bullish movements in Ethereum’s price. Each time exchange reserves fell, market activity shifted toward renewed momentum. Current data suggests this trend could repeat, creating a new cycle of price strength.

Supply Shock Potential

A significant drop in available tokens often produces a supply shock across markets. Such shocks reduce liquidity and amplify price volatility. Consequently, Ethereum now faces conditions that could trigger sharp upward movements if demand strengthens.

Source: mitrade.com

When fewer tokens remain on exchanges, markets become more sensitive to inflows of capital. Even moderate increases in buying can push prices higher quickly. This imbalance between limited supply and potential demand forms a strong foundation for volatility.

Past events support this view, as reserve drops often aligned with periods of accelerated price gains. Ethereum’s ongoing decline in exchange balances mirrors those earlier setups. Therefore, the likelihood of another strong rally appears increasingly plausible.

Market Performance

Ethereum trades at $4,164.49, posting a 2.89% daily gain, highlighting resilience after recent corrections. Despite short-term dips, the broader trajectory remains upward. Price action suggests renewed confidence following earlier pressure.

Weekly losses stand at 6.22%, while monthly performance shows a 7.6% decline. These pullbacks highlight market uncertainty but appear corrective in nature. Overall momentum remains positive when viewed against longer timeframes.

Over six months, Ethereum surged 108%, while one-year growth reached 54.58%. Such performance reflects structural strength within the asset’s broader cycle. Therefore, Ethereum maintains strong long-term momentum despite short-term volatility.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.