- Ethereum posted -45.41%, +36.48%, and +70.4% quarterly performances.

- Analysts say consolidation around $4,000–$4,500 decides next breakout.

- U.S. government now controls over $281 million worth of Ethereum.

Ethereum has posted its best quarterly performance in over three years. Analyst Daan Crypto Trades reported that Ethereum delivered its strongest quarter since Q1 2021.

Despite a recent pullback, he said the overall trend remains bullish. Data showed Ethereum moved through extreme swings this year, recording -45.41% in one quarter, then +36.48%, followed by a surge of +70.4%.

Daan explained that pauses in price action prevent rapid reversals and allow long-term trends to form. He described the results as “insane,” noting that such strong gains are unusual.

Key Resistance Levels in Focus

Ethereum has tested major resistance between $4,000 and $4,500. Traders view this breakout zone as a turning point for future momentum.

If Ethereum sustains levels above the range, analysts see a possible rally toward $7,500–$8,000. The weekly chart highlights a bullish continuation pattern, supporting the outlook for further upside.

However, a rejection could bring a retest of nearly $3,500 in support. Traders emphasize that consolidation remains critical before another major move higher. They note that strong volume and sentiment will decide whether Ethereum enters a new growth cycle.

U.S. Government Expands Ethereum Holdings

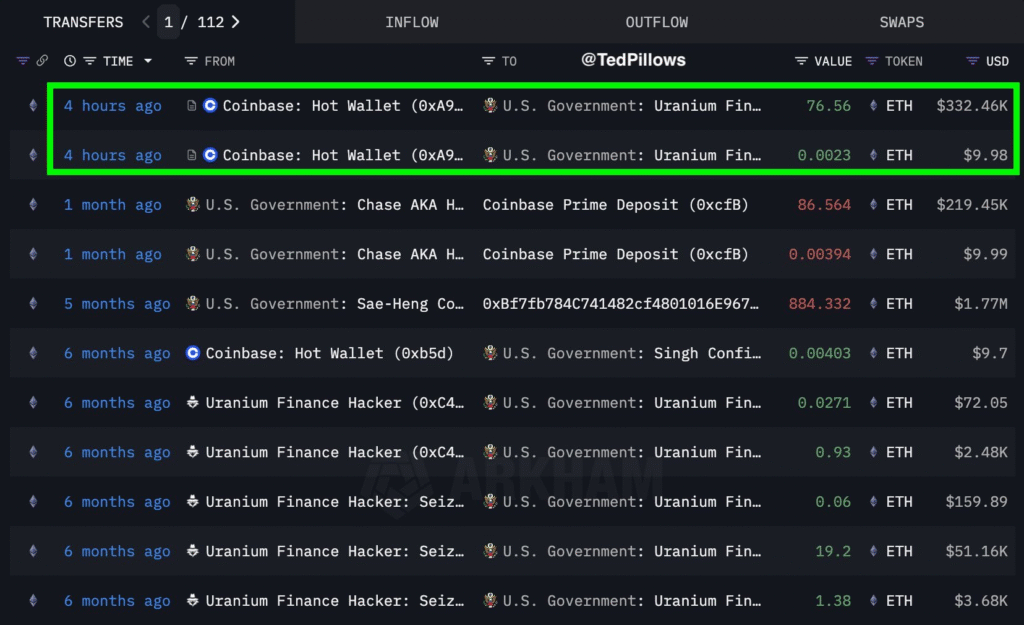

Analyst TedPillows reported that the U.S. government recently acquired 76.56 ETH, valued at $332,460. The funds were transferred from a Coinbase hot wallet and are tied to the Uranium Finance case.

This purchase increases the government’s Ethereum reserves to more than $281 million. Analysts suggest the move indicates confidence in Ethereum’s value and reflects growing official involvement in cryptocurrency markets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.