- Ethereum trades near $2K, sitting at key long-term weekly demand

- Failure to hold $2K support may lead to drop toward $1.5K

- ETH shows continued weakness when compared to Bitcoin performance

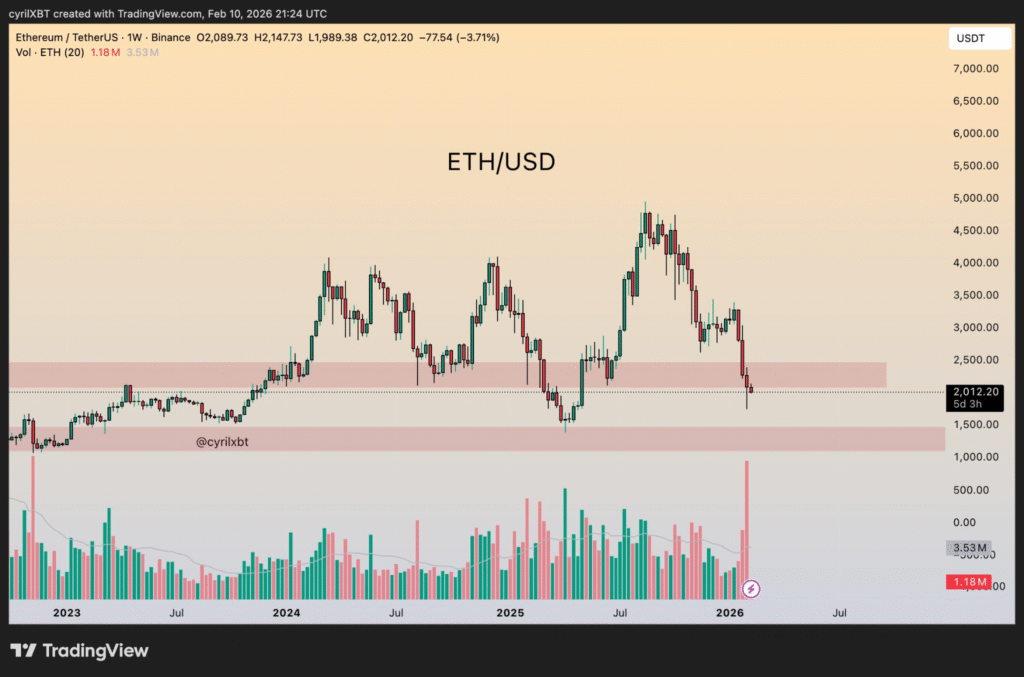

Ethereum is testing a key long-term support level near $2,000 on the weekly chart. A break below this zone may open the path toward $1,500. Traders are closely watching whether the level holds or gives way to further downside.

Ethereum Nears Key Weekly Support Zone Around $2K

Ethereum (ETH) is trading near a major long-term support level at $2,000, according to analyst Cyril-DeFi. The ETH/USD pair closed the week at $2,012.20, down 3.71%. This price level marks the lower boundary of a demand zone that has historically provided strong buyer interest.

The weekly chart shows that ETH has tested this support zone several times since 2023. While price has bounced in previous attempts, current momentum is weak. This area is now considered a “hold-or-fail” level, as a breakdown could expose Ethereum to deeper losses.

Risk of Breakdown Could Push ETH Toward $1.5K Support

Cyril-DeFi stated that if the $2K level fails, the next downside target could be the $1,500 zone. This area acted as support during multiple phases of the last market cycle and may again offer buyer interest if tested.

ETH continues to lag behind Bitcoin, both structurally and in strength. Recent price movement shows lower highs and lower lows on the weekly chart. The current volume spike also suggests heavier selling pressure. Whether buyers defend the $2K zone or allow a breakdown may define the trend in the coming weeks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.