- Ethereum faces critical $4,500 resistance, with bulls eyeing the $5,000 mark.

- SharpLink’s $3.7B ETH treasury boosts institutional adoption, fueling optimism.

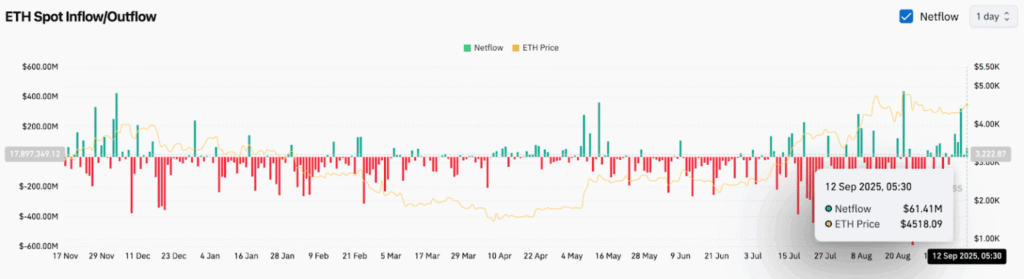

- Net inflows of $61M signal increased buying interest and potential breakout.

Ethereum ($ETH) has recently shown signs of a potential breakout as it tests a crucial resistance level at $4,500. According to crypto analyst Ali Martinez, this price zone has proven to be a strong ceiling, with multiple rejections over the past weeks.

Despite these setbacks, the latest market movement indicates that Ethereum is building bullish momentum, having formed consistent higher lows and showing upward pressure.

Martinez believes that if Ethereum manages to break through the $4,500 resistance, it could potentially set its sights on $5,000. The recent market behavior suggests that demand for Ethereum is rising, and the formation of strong candle patterns indicates the likelihood of further upside movement.

Institutional Adoption Grows with Ethereum Treasury Strategy

Ethereum’s recent surge in interest can also be attributed to institutional adoption, particularly SharpLink Gaming’s example. Co-CEO Joseph Chalom recently referred to his firm’s $3.7 billion Ethereum treasury as a “white swan event” for Ethereum.

The company now holds over 837,000 ETH, accounting for nearly 0.7% of Ethereum’s circulating supply. Unlike speculative holdings, SharpLink views Ethereum as a reserve asset, similar to Michael Saylor’s approach to Bitcoin.

This strategy, which emphasizes transparency and long-term accumulation, is seen as a key factor in institutional investors’ growing confidence. SharpLink plans to release weekly disclosures of its holdings and staking rewards to maintain transparency, distancing itself from practices seen with failed companies like FTX.

Renewed Buying Pressure Signaled by On-Chain Flows

Meanwhile, Coinglass data further supports the bullish sentiment surrounding Ethereum. On September 12, Ethereum saw a net inflow of $61.4 million, marking one of the strongest accumulation signals in recent months. This positive flow follows several months of mixed activity, where outflows were more dominant.

The growing inflows indicate that traders are positioning themselves for a potential breakout above $4,500. However, analysts suggest that continued inflows above $100 million will be necessary to confirm sustained buying pressure and create the momentum needed for Ethereum to approach the $4,800-$4,950 range.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.