- Exchange balances fell to ~16M ETH, a structural decline driven by staking, L2 migration, and self-custody.

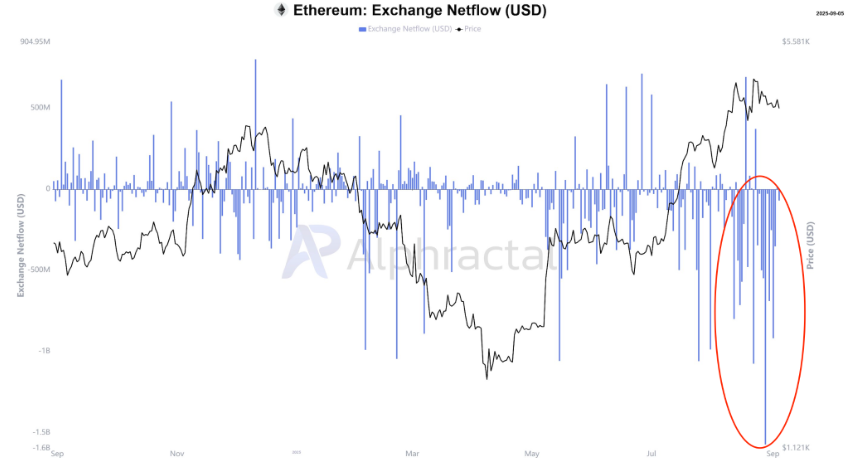

- Netflows have printed persistent negatives since late August, signaling coins leaving exchanges.

- ETH trades in a compressing triangle; a sustained close above $4,500 would confirm upside, while $4,200 then $4,080–$3,960 are key supports.

Ethereum edged higher by 0.73% on the day, yet on-chain signals turned more decisive. Exchange flux for Ethereum flipped negative, implying a shrinking sell-side float. Consequently, the backdrop favors efficient upside if demand persists and net outflows continue.

Exchange Balances Return to 2016 Levels

Glassnode data show exchange balances falling to about 16 million ETH, near 2016–2017 levels. Balances have trended lower since the 2020 peak in the mid-30 million range. The decline marks a structural shift rather than a short-term blip.

Source: Glassnode

Post-2020 staking, liquid staking, and self-custody have redirected ETH away from centralized venues. L2 migration and smart-contract locks further reduced readily sellable supply. As a result, fewer coins sit on order books awaiting bids.

Tighter exchange inventories typically reduce immediate sell pressure when demand holds. Therefore, marginal buy flows can move price more efficiently and with less depth. However, thinner books can also amplify volatility during shocks or headlines.

Exchange Netflows Print Historic Negative Streak

An exchange netflow dashboard shows dense clusters of negative USD prints since late August. Persistent withdrawals indicate coins are moving to staking, bridges, and DeFi rather than to spot venues. Price held above prior ranges while outflows strengthened the “tight float” narrative.

Source: Alphractal

Sustained outflows combined with low balances point to reduced near-term distribution risk. In that regime, incremental buying can translate into faster price advances. Yet a sharp flip to positive netflows would warn of supply returning to markets.

Accordingly, watch for any break in the pattern, including rising exchange inventories. Monitor order-book depth and spot volumes alongside netflow direction. Continued negative prints with higher lows would keep the signal constructive.

ETH Price Structure and Immediate Levels

On the four-hour chart, ETH trades within a compressing triangle above the reclaimed support level. Price oscillates between converging trendlines after the August pullback. The setup favors a directional break as volatility compresses.

Source: Jelle

Upside validation arrives with a clean push above the descending trendline and local supply. A sustained close above the $4,500 area would confirm momentum. Until then, the pattern remains a range with defined edges.

Downside risk sits near $4,200, then the $4,080–$3,960 demand block. Losing those levels would open a deeper retracement toward $3,720. Conversely, holding higher lows would keep the breakout bias intact.

Outlook and Risk Markers

The return of exchange balances to eight-year lows signals scarce on-exchange supply. Concurrently, negative netflows reinforce a regime where fewer coins are available to sell. Therefore, any demand impulse can translate into outsized moves.

Confirmation of a durable advance still benefits from supportive spot volume. An ETH/USD breakout paired with continued net outflows would strengthen the case. Improving activity on L2s and steady staking participation would add further backing.

Key risks include a sudden inflow spike to exchanges and macro risk-off shocks. A decisive netflow reversal alongside price weakness would negate the supportive backdrop. Until then, negative exchange flux hints at tightening supply for Ethereum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.