- HBAR’s ETF inclusion boosts investor confidence and targets up to $1.80.

- Supply growth hasn’t limited HBAR’s price as network demand strengthens.

- Rising TPS and DeFi growth underscore Hedera’s catalysed ecosystem adoption.

Hedera Hashgraph ($HBAR) has continued to perform strongly as investor confidence grows. The network recently achieved inclusion in six U.S. ETF filings, a milestone that reflects broader institutional attention.

According to Gilmore Estates, the filings involve leading asset managers such as Grayscale, Canary, REX-Osprey, and KraneShares. Analysts estimate that the probability of ETF approval by the fourth quarter of 2025 stands between 60% and 80%.

This development marks a turning point for Hedera as it transitions from a developing blockchain platform to a network integrated within the mainstream finance sector. The growing participation of established firms signals advancing adoption and recognition in institutional circles.

Analyst Data Shows Strength Despite Expanding Supply

Hedera’s price performance has remained strong even with an expanding token supply. Analyst CrediBULL Crypto noted that in 2021, with 8 billion tokens circulating, HBAR rose from $0.04 to $0.40 in 60 days.

In 2024, despite a circulating supply of 35 billion, the token achieved a similar tenfold rally within 30 days. The analyst stated that “supply growth has not limited price action due to sustained market demand and renewed investor activity.”

The findings suggest that Hedera’s price behavior is driven by network momentum rather than token dilution.

Network Throughput Shows Rapid Expansion in 2025

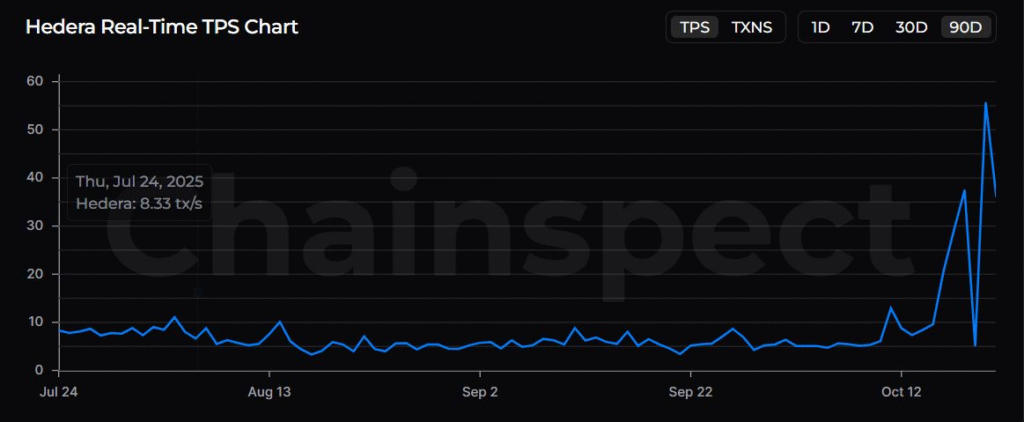

Recent performance metrics show Hedera’s transaction throughput rising rapidly. Chainspect data indicates that its transactions per second (TPS) rose by 32.75% within one hour this month.

Further verification from ChainSpect indicates continuous growth in network throughput, supported by expanding decentralized finance (DeFi) operations. The data reflects increasing activity and adoption across Hedera’s ecosystem as its utility strengthens in 2025.

With expanding network participation, accelerating transaction activity, and institutional engagement through ETF filings, Hedera Hashgraph continues to demonstrate steady market maturity and operational resilience.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.