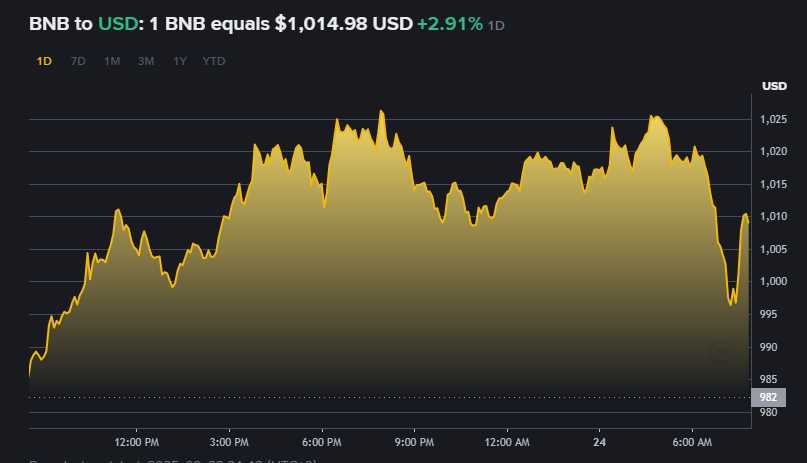

- BNB has a good above $995 support and repeated rebounds have strengthened the bullish base at the psychological level of $1,000.

- The targets on the upside are still evident and the technical barrier is at 1,350 and the medium-term profit-taking level is at 2,000.

- The consolidation remains in the range of 995 to 1025 and a break out above 1050 may give the momentum an impetus to even higher levels.

BNB was trading close to $1,015, and it had a 2.91 percent increase in 24 hours. The token shot up sharply below during the time of less than 995 and hit highs of more than 1,020 intraday. Nonetheless, price action showed instant opposition at the 1020-1035 area where the trend was constantly decelerating.

The traders noted that the 995 was a good intraday floor and this would prove it to be a strong area of support in the near term. Each time there was a pullback to this point it sparked off new purchases, and the token rose to the psychological level of above 1000.Maintaining these levels strengthened expectations of higher price targets.

Analysts pointed to $962 as the critical longer-term support that underpins the bullish structure. If BNB holds above this level, sentiment could remain constructive. Breaking below it, however, could trigger a faster decline.

Short-Term and Medium-Term Targets

Current market focus remains on two potential targets derived from previous resistance levels. The first short-term target sits at $1,350, aligning with the next technical barrier. The second target points to $2,000, which reflects longer-term profit-taking potential.

Source: Binance

BNB recently peaked at $1,080, marking an all-time high before pulling back. Since then, it has consolidated while respecting the ascending support trend. This setup provided buyers with opportunities to re-enter positions without breaching major downside zones.

The alignment between these targets reflects strong conviction among market participants tracking the same levels. Short-term resistance remains near $1,025, while continuation above $1,050 could build momentum. Sustained buying pressure may accelerate the journey toward higher thresholds.

Market Outlook and Risk Factors

BNB’s overall outlook remains constructive while it trades above $995 and $962. These support levels define the line between continuation and correction. Breaking either could shift sentiment rapidly and increase selling pressure.

The action above the price of 1,000 fortified the bullish side of the market, yet additional force will need greater catalysts and additional trading. Resistance levels still hover close to near-term gains postponing the shift towards $1,350. Nevertheless, investors who consistently protect falling markets indicate that they have consistent trust in the direction of the token.

The consolidation is expected to persist in the range of 995 to 1,025 in the eyes of the market watchers. The capacity to break out of the resistance would open the door to 1,100. Thus far the rally will be supported by the key.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto Newz does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.