- INJ remains range-bound with $10 support and $16.15 resistance.

- Coinbase’s quiet accumulation signals institutional confidence in Injective.

Injective (INJ) is at a critical technical level as price action shows signs of consolidation and uncertainty. Crypto analyst Crypto Tony reported that the INJ/USD pair remains in a range-bound pattern, with clear support and resistance levels.

According to his chart analysis, INJ has failed to break through the $16.15 resistance zone, retreating to around $13.20 before dropping further. This resistance level represents a crucial threshold for the continuation of any recovery move.

Earlier, INJ found support just above $10, marking a local bottom after a sustained decline. Since then, the asset staged a modest recovery but has now entered a consolidation below overhead resistance.

Price action remains confined between $10 and $16.15, indicating limited bullish follow-through. Without a decisive breakout above the ceiling, INJ may continue to move sideways.

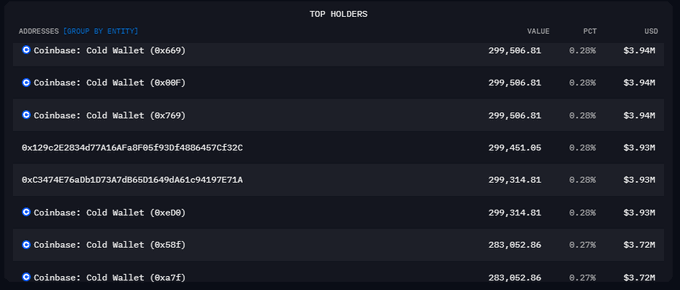

Coinbase Accumulating INJ Across 25 Cold Wallets

Reports have emerged that Coinbase has been quietly accumulating INJ, dispersing holdings across at least 25 separate cold wallets. These wallets contain only INJ tokens, with the largest holding close to 300,000 INJ. Several others show similar volumes, suggesting a coordinated accumulation strategy.

This pattern has sparked speculation among traders and analysts about Coinbase’s motivation behind its actions. While no official statement has been released, many in the community believe this indicates institutional positioning. One user on social media responded to the trend by saying, “I bought the dip,” reflecting rising retail interest as well.

Short-Term Outlook Hinges on $11.80 Support

INJ’s bullish bias remains valid as long as it trades above $11.80. At the time of writing, INJ is trading at $11.53, down 1.25% over the past 24 hours. The token initially showed upward movement, reaching near $11.90, before declining and briefly dipping below $11.30. It then saw a minor late-day recovery.

According to Coincryptonewz analysis, technical indicators suggest that the MACD and moving averages reflect continued buying interest. If momentum returns, analysts expect a push toward the $15 range. A breakout beyond $16.15 could open the path to a short-term target near $26.

However, failure to hold the $11.80 support may shift sentiment bearish. With the price now below this level, traders will closely monitor whether a rebound follows or if further downside unfolds. Until a clear breakout occurs, the market may remain confined within its current range.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.