- Injective shows strength reclaiming $9 support inside long-term channel.

- Institutional ETF filings may unlock trillions in sidelined capital.

- RWA and GPU markets highlight Injective’s expanding infrastructure role.

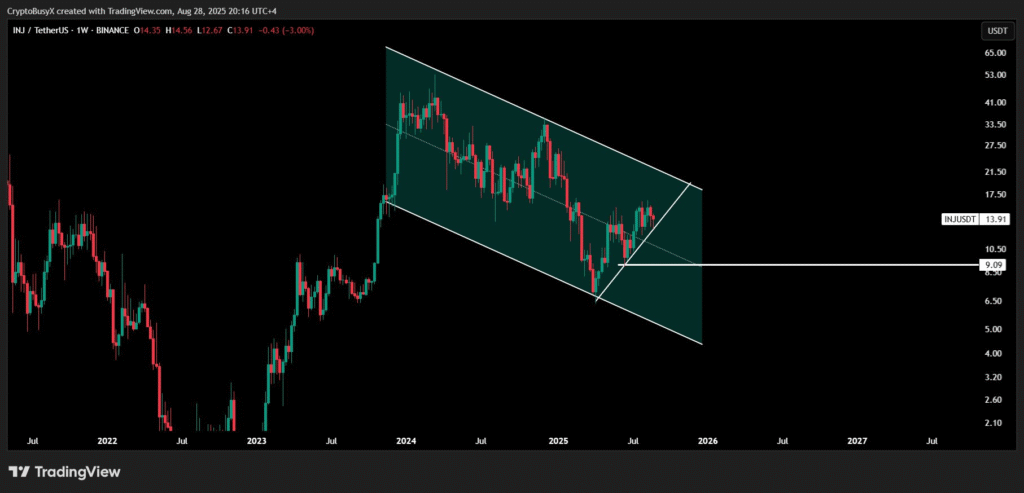

Injective ($INJ) has regained traction in recent trading. CryptoBusy data showed that Injective has been moving inside a broad descending channel for months. The recent bounce above $9 positioned the asset near the center of this structure.

Analysts explained that buyers are eyeing the upper boundary as the next target. They emphasized that a breakout from this range may signal the start of a bullish cycle.

This level will be critical for traders monitoring Injective’s direction. With the token pressing against mid-range resistance, its price behavior in the coming weeks will determine whether momentum can carry toward the channel’s upper boundary.

Long-Term Holdings and Infrastructure Role

CryptoBusy reported that Injective holdings have gained +55.28% in spot, even while the wider market stayed volatile. The increase came from conviction-based holding rather than active trading.

Analysts described Injective as more than a speculative play, highlighting its role in blockchain infrastructure. They compared its utility positioning to that of Ethereum ($ETH) and Bitcoin ($BTC).

According to the report, Injective is building institutional-grade frameworks with a focus on real-world applications. These include RWA perpetuals, GPU marketplaces, and tokenized asset platforms.

Such tools could help expand institutional adoption and support long-term growth in the sector. Analysts added that the project’s tokenomics upgrades and expanding application base strengthen its case as a key infrastructure player.

Institutional Access Through ETF Filings

According to Injective data, several top 100 digital assets, including $TRUMP and $INJ, have begun filing S-1 forms for ETFs. Analysts noted that this marks a key step toward broader institutional access beyond Bitcoin exposure.

They said that compliant entry points are critical as traditional firms look to diversify into alternative assets. Experts added that trillions in sidelined capital may become available as demand for secure products grows.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.