- Injective’s TVL increased by 77% in August, reaching over $34 million.

- Injective reports a 1,400% rise in RWA perpetuals volume this year.

- SEC’s comment period for $INJ ETF approval boosts investor confidence.

Injective (INJ) is showing signs of a possible major price breakout. Analysts note the token has entered a consolidation phase, with the price stabilizing around key long-term trendline support.

This setup is reminiscent of previous cycles where Injective experienced significant rallies. Historical data suggests that the last rally surpassed 3,500%. This time, the market could be positioning itself for a similar surge.

Solid Monthly Performance Boosts Confidence

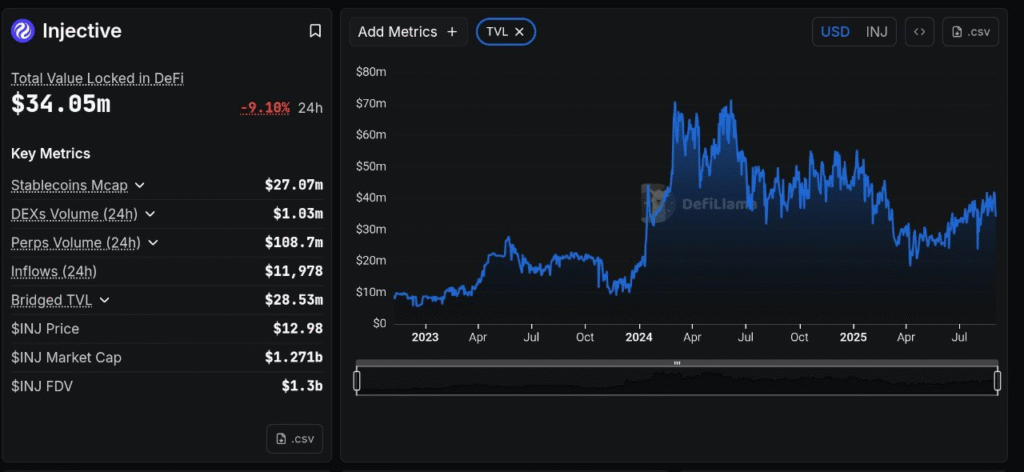

Injective’s performance over the past month has been impressive. DefiLlam data reports a 77% increase in the Total Value Locked (TVL), reaching over $34 million.

Despite a 9.10% dip in the last 24 hours, Injective’s TVL has remained strong, reflecting increased interest in its ecosystem. The protocol also saw significant growth in daily active addresses, peaking above 93.6k, indicating robust network engagement.

Revenue generation has also reached a new milestone. Injective earned $117.5k in protocol earnings, further proving its growing presence in decentralized finance (DeFi).

Analysts also point out that the growth in RWA perpetuals volume, which surpassed $107 million, represents a massive 1,400% increase since January. This surge reflects strong user demand for Injective’s financial products.

Institutional Interest and Global Adoption Drive Growth

Injective has been making strides in institutional adoption, especially with the progress on its $INJ ETF. The U.S. government’s increasing focus on blockchain and the recent opening of the comment period for the ETF by the SEC are being viewed as positive steps.

If approved, the ETF could attract more institutional investors, further solidifying Injective’s position in the DeFi space.

The platform is also gaining traction in global markets. In Japan, the Injective community has been actively pushing for adoption, strengthening its international presence.

Analysts expect that as these initiatives unfold, the protocol’s growth momentum will continue to build, creating opportunities for a broader user base and more widespread adoption.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.