- After a sharp decline, Bitcoin is currently in a consolidation phase, which may lead to a significant price surge.

- A rise in volume during a breakout would signal a strong upward move for Bitcoin, confirming market conviction.

- The recent stabilization after a price drop has positioned Bitcoin for a possible recovery, with traders anticipating a surge after consolidation.

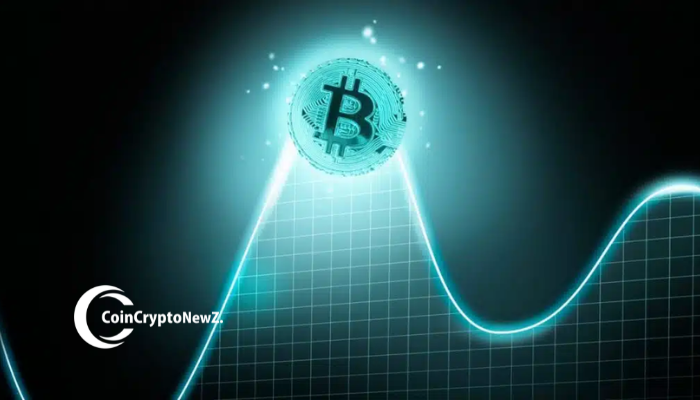

Bitcoin’s price has recently undergone a significant drop, followed by a period of consolidation. This chart shows Bitcoin’s price action, characterized by a sharp decline, followed by a sideways movement. The consolidation phase is critical for determining whether Bitcoin will continue to struggle or experience a breakout.

Bitcoin’s Price Action: A Typical Dip and Stabilization

Bitcoin’s price recently experienced a steep drop, a common occurrence in volatile markets. After the decline, Bitcoin entered a phase of stabilization, where the price moved sideways for a period. This sideways movement is known as consolidation, where the market finds temporary balance before deciding on the next direction.

In technical analysis, this pattern often suggests that Bitcoin is forming a base after the drop. The consolidation serves as a support level where the price can gather momentum for the next move. While consolidation periods can lead to different outcomes, in this case, the chart suggests that an upward breakout is more likely.

What to Expect After Consolidation?

Following the consolidation phase, Bitcoin might experience a breakout, a scenario that many traders anticipate. The chart illustrates a potential breakout pattern, with the price rising sharply after the consolidation. A breakout typically signals the end of a period of indecision, leading to more significant price movements.

Bitcoin’s price trajectory is expected to follow the dashed line, moving upwards as it breaks free from the consolidation. The market could be gearing up for a surge if the breakout occurs as anticipated. This potential price rally would mark a strong recovery from the recent dip.

Volume Analysis and Market Sentiment

Looking at the volume bars on the chart, there is a notable surge in volume during Bitcoin’s initial drop. As the price stabilized, volume decreased significantly, indicating a period of indecision among traders. Consolidation phases are often associated with lower volume, as fewer market participants engage in trades during periods of uncertainty.

When Bitcoin breaks out from the consolidation phase, volume is expected to rise again. Higher volume during the breakout would validate the move and indicate strong market conviction. A sharp increase in trading activity would confirm that Bitcoin is on the verge of a significant upward movement.

Market Outlook for Bitcoin’s Future Movements

Bitcoin’s price is currently at a critical juncture after the consolidation phase. If the breakout occurs, the market could experience a significant surge, driving Bitcoin to new levels. However, as with any technical analysis, the future price movement depends on the strength of the breakout and the overall market sentiment.

The consolidation phase has helped Bitcoin stabilize after a major decline, and the current sentiment is cautiously optimistic. Traders are hoping for a recovery, with many speculating that Bitcoin is ready to rise after the consolidation. If this technical setup plays out as expected, Bitcoin may soon see a strong surge in price, marking the end of its recent downturn.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.