Dogecoin’s price chart points to a potential reversal, with $1 marking a critical level for support or resistance.

Moving averages and MACD signals indicate bearish momentum, suggesting the possibility of continued declines.

While Dogecoin shows slight short-term gains, the overall trend remains uncertain, with consolidation or further declines likely.

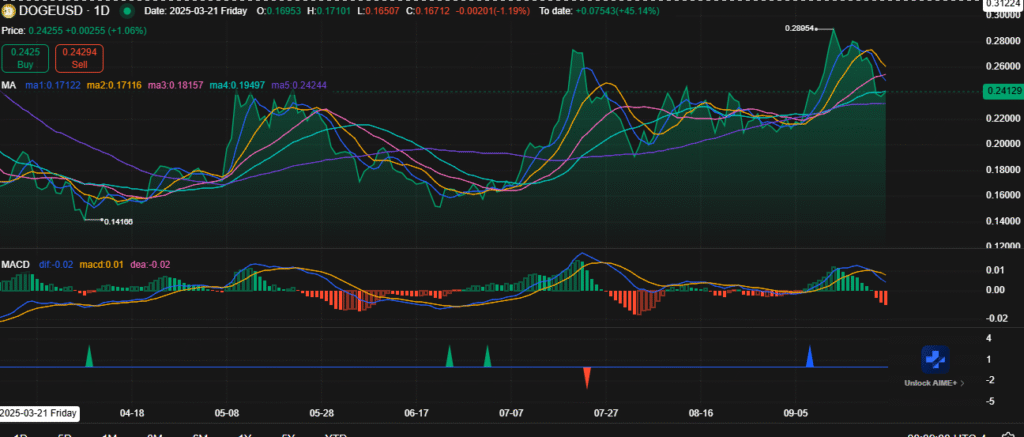

Dogecoin (DOGE) has experienced a shift in momentum over the past few years, with a bearish target of $1 gaining traction. The cryptocurrency’s price chart, which spans from 2021 to 2025, highlights a significant downward trend. The price movement appears to be approaching a potential reversal, with $1 serving as a critical level to watch. Although there has been a slight uptick of 0.54%, the overall trend remains uncertain, with technical indicators suggesting downward pressure.

Dogecoin’s price trajectory from 2021 to 2025 has been marked by a noticeable decline, particularly in the years 2022 and 2023. After a period of significant volatility, including lower highs and lows, the cryptocurrency saw a brief rally beginning in mid-2024. This brief upward movement peaked around early 2025, only to face a sharp decline. The horizontal line at $1 on the chart suggests that this level could serve as a major support or resistance point, indicating a potential market reversal.

While the recent uptick has provided some short-term optimism, the long-term picture remains aligned with bearish expectations. The $1 mark could signify the end of the recent rally, with a possible correction coming into play. The chart’s focus on this critical level highlights how the market may view the $1 target as an area for potential support.

Moving Averages and MACD Signal Further Declines

Moving averages (MA) and the Moving Average Convergence Divergence (MACD) indicator present mixed signals for Dogecoin’s price action. The chart displays five distinct moving averages, ranging from short-term to long-term indicators, with the price hovering between the MA4 (blue line) and MA5 (green line). This positioning indicates that, while the price is above the lower-moving averages, it has yet to surpass the higher ones, pointing to a lack of clear upward momentum.

Source: chart.ainvest

The MACD, which tracks the difference between short-term and long-term exponential moving averages, currently shows a negative reading. The red histogram bars in the MACD section suggest downward momentum, supporting the bearish outlook. However, green bars forming at the end of the histogram suggest that there may be a slight reversal on the horizon, though this remains speculative.

Despite the recent positive movement, Dogecoin’s price remains trapped between key moving averages, reflecting the market’s indecision. With the MACD showing a negative trend and the price fluctuating around the moving averages, it seems likely that the market is bracing for consolidation. Investors looking for confirmation of a trend reversal may need to observe how the price interacts with the key levels in the coming weeks.

The Outlook for Dogecoin’s Price Movement

The recent uptick in Dogecoin’s price suggests that short-term momentum is positive. However, the broader trend remains uncertain, with technical indicators pointing to downward pressure. The price has struggled to break past higher moving averages, reflecting a lack of sustained upward movement. As a result, the market may face a consolidation phase or continued declines if the bearish momentum persists.

Traders and analysts will be paying attention to how Dogecoin reacts to key technical levels, especially the $1 mark. A significant move below this threshold could confirm the bearish outlook, while a reversal could point to a possible recovery. Either way, the coming weeks and months will be crucial in determining whether Dogecoin can break free from its current range-bound behavior or faces further declines.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.