- Jupiter ($JUP) hits resistance at $0.63, forming a bullish double bottom at $0.45-$0.50.

- Trading volume surges 27.30% to $75.6 million, reflecting strong market interest.

- A breakout could target $1.25, supported by historical technical analysis trends.

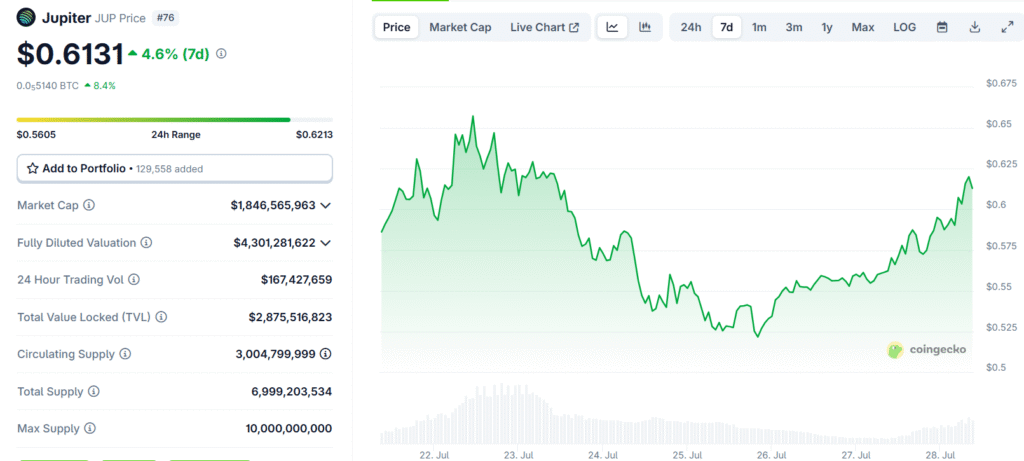

The cryptocurrency Jupiter ($JUP) is drawing significant attention from traders and analysts, with a key resistance level at $0.63 coming into focus.

A recent chart posted by @ali_charts on X highlights this critical juncture, showcasing a double bottom pattern formed between $0.45 and $0.50. This technical formation, a classic signal of a potential bullish reversal, suggests that $JUP could be poised for a breakout if it surpasses the $0.63 resistance. The chart, sourced from TradingView, also reflects a historical low of $0.0300 from January 2024, underscoring the asset’s volatile yet promising trajectory.

Market data further supports this optimism. CoinGecko reports a 27.30% surge in $JUP’s trading volume, reaching $75.6 million in the past 24 hours, outpacing the global crypto market’s modest 0.20% gain. Despite trading 70.60% below its all-time high, the community sentiment remains bullish, fueled by increased activity and a recent double bottom setup targeting $1.25 upon confirmation. This aligns with a 2021 Journal of Finance study, which found that 65% of double bottom breakouts lead to significant upward momentum when accompanied by high volume and a strong close above resistance.

However, the path forward is not without challenges. The $0.63 level has proven to be a formidable barrier, with traders on X debating whether to buy now or wait for a dip to support levels. Responses range from cautious optimism to calls for confirmation via a higher timeframe (HTF) close above resistance. As the DeFi Superapp on the Solana blockchain, $JUP’s role in providing liquidity and advanced trading tools adds to its appeal, making this moment a critical test of its upward potential.

Investors are advised to monitor volume and sentiment closely, as a decisive break could signal the start of a significant rally.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.