- Kaspa rebounds from $0.048 support and forms a bullish Bump-and-Run pattern.

- Price nears $0.05646 resistance, the 200-hour moving average on charts.

- Sustained buying pressure may lift Kaspa toward $0.06359 short-term target.

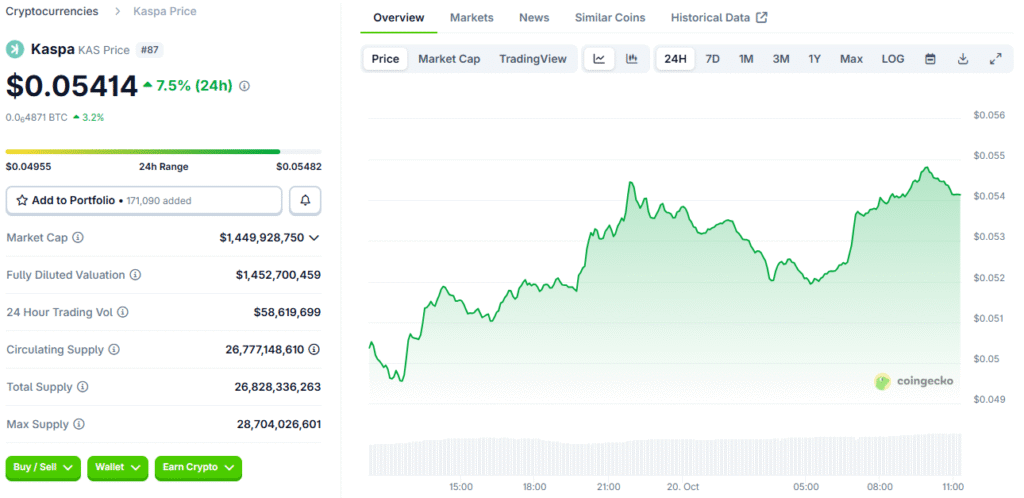

Kaspa (KAS) has gained over 7% in the past 24 hours, reaching $0.05414. The move comes as traders identify a bullish technical setup forming on lower timeframes. The pattern suggests the possibility of an extended upward phase if momentum holds above key resistance levels

The cryptocurrency market began the week in green territory, with Bitcoin and Ethereum posting steady gains. This renewed sentiment lifted altcoins, including Kaspa, which has drawn attention from technical traders due to its developing reversal structure.

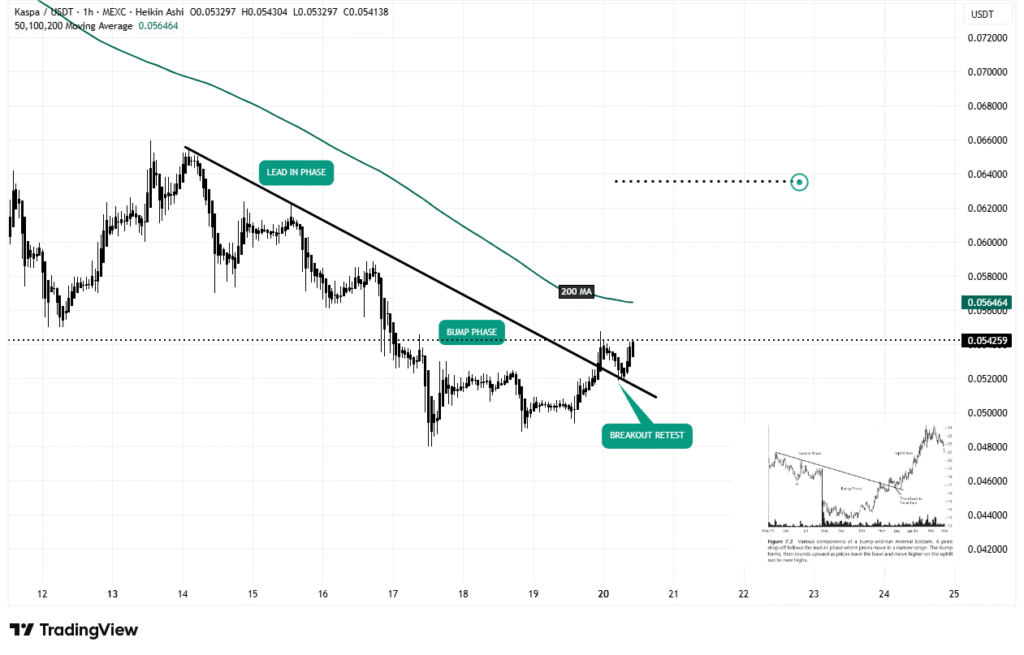

Bump-and-Run Reversal Pattern in Formation

Kaspa’s one-hour chart shows signs of a developing Bump-and-Run Reversal (BARR) pattern. This structure often forms when an asset shifts from a bearish phase to a potential uptrend.

The lead-in stage began when Kaspa faced rejection around the $0.06551 level, leading to a decline toward the $0.048 zone. After this low, the price rebounded sharply, moving above its descending trendline and later retesting it for confirmation. Analysts often view this technical retest as a signal of strengthening market structure.

At press time, Kaspa trades just below its 200-hour moving average of $0.05646. A decisive close above this mark may confirm the breakout and initiate the pattern’s next phase.

Traders Eye $0.06359 Target if Breakout Holds

If bullish momentum persists and the breakout sustains above the moving average, the next potential target is around $0.06359. This would represent a 17% gain from current levels. However, a failure to clear resistance could trigger short-term consolidation near $0.050 before the next move.

Market analysts note that as long as Kaspa holds above its $0.050 support region, the bias remains positive. Traders will continue monitoring price action to determine whether the ongoing reversal will translate into a broader rally in the coming sessions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.