- Lido DAO holds near $0.90 as chart support around $0.45 gains attention.

- ETF filing sparks renewed focus on LDO and stETH from institutions.

- RSI remains neutral while analysts forecast stable LDO trend through 2025.

Lido DAO’s native token, $LDO, remains near $0.90 after recent volatility. Market experts and chart analysts are closely watching a potential support zone around $0.45.

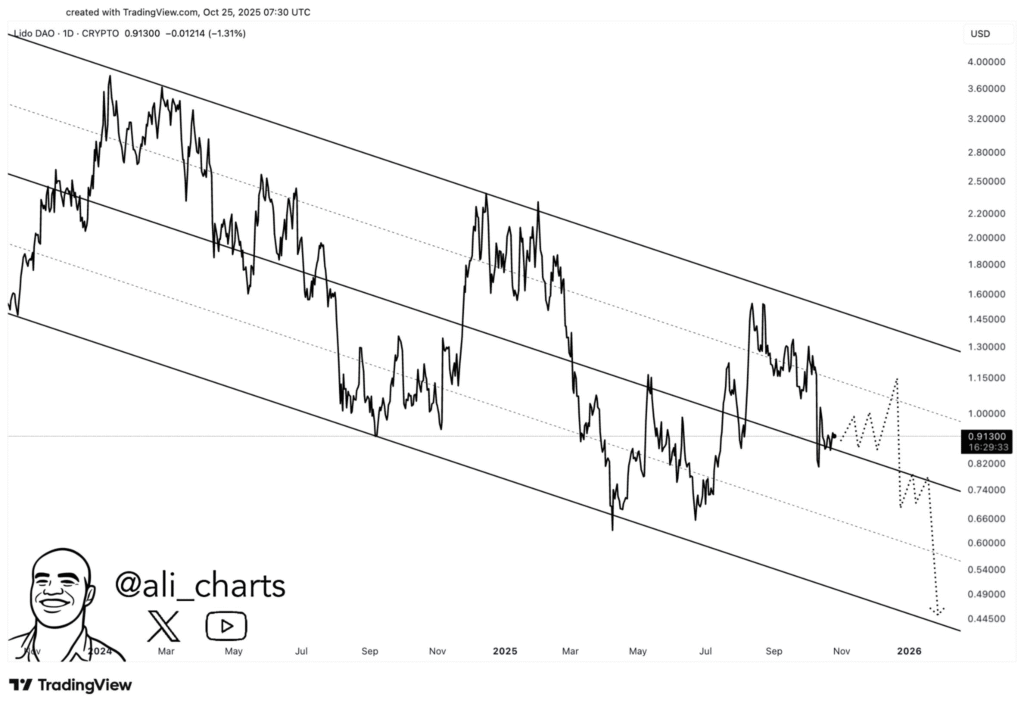

This level is viewed as a potential price floor if bearish momentum persists. According to crypto analyst Ali Martinez, $LDO remains inside a descending parallel channel and could either bounce above $1.00 or fall toward $0.45.

The chart shows projected paths for LDO moving into early 2026, with technical pressure guiding the price either way. Current consolidation suggests that the token may be preparing for a shift, although its direction remains unclear. Martinez stated that $0.45 is a “solid support,” based on historical price reactions within the same trend pattern.

ETF Filing Draws Institutional Attention to stETH and Lido DAO

On October 20, asset manager VanEck filed an S-1 registration with the U.S. SEC. The proposed ETF, named VanEck Lido Staked ETH ETF, would hold stETH, Ethereum staked through the Lido protocol. Lido Finance confirmed the news on social media, calling it a “milestone moment for liquid staking.”

This development has brought institutional focus to both stETH and $LDO, as it ties Ethereum staking to traditional finance structures. While the ETF awaits approval, market participants are assessing the broader impact on staking demand and protocol-related tokens, such as LDO. Analysts believe such filings can increase long-term confidence in the ecosystem.

Technical Indicators Show Consolidation in LDO

From late October 2025, LDO has been trading within neutral territory. The Relative Strength Index (RSI) hovers around mid-range, indicating no major overbought or oversold pressure. Moving averages remain flat, suggesting a consolidating trend.

Despite recent bearish sentiment, forecasts expect LDO to remain between $0.90 and $1.10 through the end of 2025.

A recent governance vote on validator exit policies may also impact liquidity and staking operations, furthering market focus. Trading volumes remain stable, reflecting consistent investor interest in the protocol and its token.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.