- Litecoin MWEB balances rise above 245K LTC worth over $23.8 million.

- Analysts forecast Litecoin could rally to $1,500–$2,000 if momentum holds.

- ETF expectations and growing MWEB adoption support Litecoin’s bullish trend.

Litecoin (LTC) is exhibiting renewed strength in its long-term price structure, supported by increasing adoption of privacy and optimism surrounding a potential exchange-traded fund (ETF). Market analysts note that Litecoin’s recent performance has attracted wider attention from traders anticipating further upside in the coming months.

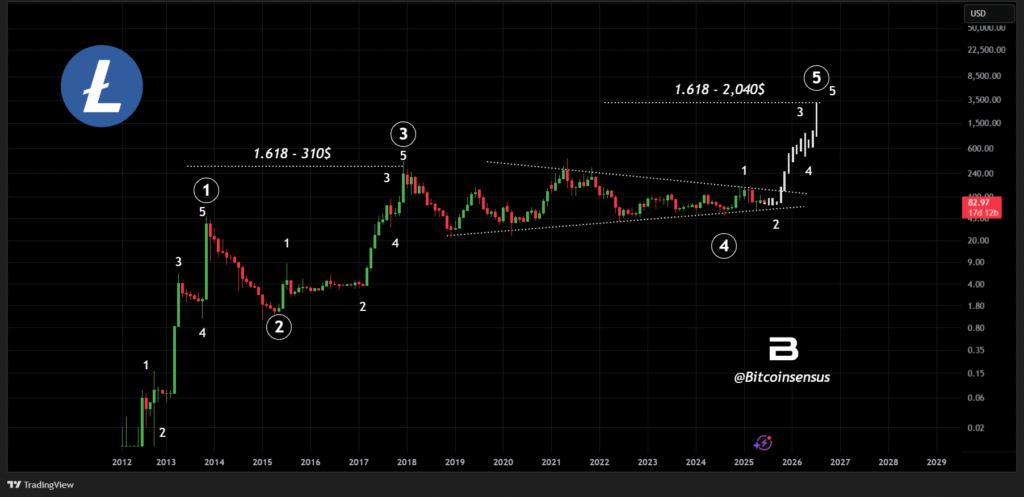

Bitcoinsensus data shows that Litecoin’s price structure follows a five-wave Elliott pattern, indicating sustained bullish momentum on the monthly chart. Historically, Litecoin has aligned closely with this pattern, reaching major peaks near the 1.618 Fibonacci extension level.

If the current wave continues, projections estimate a possible rally between $1,500 and $2,000 per coin. Analysts suggest that the approval of a Litecoin ETF could attract institutional investors and enhance market liquidity.

MWEB Growth Strengthens Network Confidence

Litecoin data indicates that over 245K LTC, valued at approximately $23.8 million, are now stored in MWEB (MimbleWimble Extension Block) addresses. Litecoin traded at around $96.87 as of late October 2025.

The MWEB chart shows a sharp increase throughout October, suggesting a steady rise in user adoption of privacy-enhanced transactions.

The growing use of MWEB demonstrates interest in privacy features and transactional flexibility. Analysts expect balances to surpass 300K LTC by year-end, reinforcing steady network activity and long-term usage growth. MWEB allows users to send confidential transactions while maintaining Litecoin’s security and transparency.

Bullish Technical Outlook Remains Intact

Litecoin has been maintaining a bullish channel since mid-October. A breakout above $160 confirmed renewed buying interest, followed by a retest near $110 before price momentum resumed. The previous resistance level of $180 has become strong support, and Litecoin now trades around $230.

Market sentiment remains optimistic, as technical indicators suggest potential for upward continuation. Analysts observe that consistent price strength, combined with growth in privacy features and anticipation of ETF listings, keeps Litecoin in focus among traders.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.