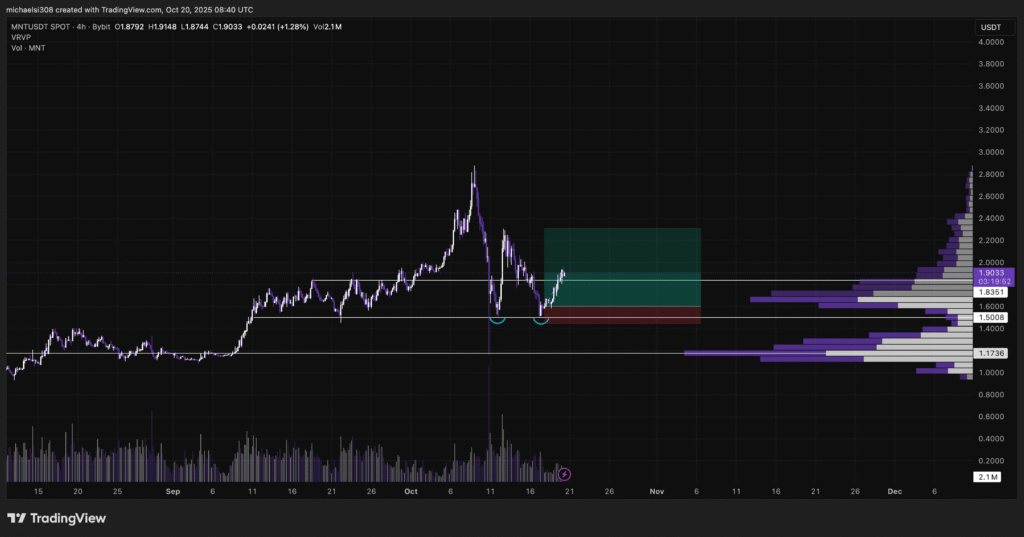

- Mantle (MNT) trades 36.27% below its $2.86 peak and 490.77% above its $0.308 low.

- $MNT formed a double bottom at $1.5, reclaiming strength toward the $2.2–2.3 range.

- Analysts note early recovery signs as short-term trends shift from bearish to bullish.

Mantle (MNT) continues to show recovery momentum after rebounding from recent lows and stabilizing around $1.83. The asset remains 36.27 percent below its all-time high of $2.86 and 490.77 percent above its record low of $0.308.

Current trading data indicates potential consolidation before an upward move toward the $2.25 resistance area. Technical charts show the token holding above key moving averages, while the Relative Strength Index (RSI) signals improving strength in the current trend.

Analysts observe that Mantle is regaining stability following last week’s market volatility. Bybit handled the market fluctuations efficiently, maintaining consistent liquidity during the brief downturn. The broader trading environment appears to be stabilizing as participants adjust positions after a period of heightened volatility.

Market Activity and Exchange Response

Market analyst Mike S noted that $MNT formed a double bottom near $1.5 before reclaiming its mid-range. “As long as $1.6 holds, setup looks constructive toward $2.2–2.3,” he commented. Bybit managed last week’s market volatility effectively, maintaining order book stability while liquidity providers adjusted positions.

Mike S further explained that Binance’s automatic deleveraging (ADL) system caused market makers to offload spot assets and withdraw liquidity. This contributed to a slower recovery and thinner books as participants remained cautious following forced adjustments.

Short-Term Strength and Structural Recovery

Analyst Teddy observed that Mantle is among the “legit builders” showing early signs of structural recovery. He stated that shorter timeframes are breaking bearish patterns, which may soon extend to longer trends.

The token’s breakout from a descending trendline confirms renewed buying activity following a period of consolidation near $1.5.

Technical indicators, including stable moving averages and improving RSI, signal strengthening momentum. As traders monitor these developments, Mantle continues to maintain resilience, positioning itself for potential growth if current levels are sustained.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.