- $NEAR is testing the $3.00 resistance, crucial for a potential breakout.

- Near Protocol sees stable growth with 3M daily active users.

- Rhea Finance supports $NEAR with DeFi solutions, boosting the ecosystem.

The price of $NEAR has been testing a critical resistance zone at around $3.00. According to Crypto Tony’s analysis, $NEAR has faced several rejections near this resistance level over the past months.

With upward momentum building in September 2025, a break above this resistance is crucial for further price advancement. A sustained move past the $3.00 level could signal a potential breakout, offering traders an opportunity to enter the market.

However, if the price fails to close above this resistance, $NEAR could face a return to lower support levels. As the price nears this critical threshold, market watchers are closely monitoring for any signs of a breakout or rejection.

User Activity Remains Strong on Near Protocol

Near Protocol’s user activity has remained consistently strong over the past several months, with daily active users averaging around 3 million. Notably, returning users make up a significant portion of this total, reflecting strong user retention and trust within the ecosystem.

For example, on June 26, the platform saw 2.9 million returning users and 280,000 new users join the network. Various factors, including the introduction of sustainable DeFi solutions like liquidity pools, vaults, and liquid staking from projects like Rhea Finance, have supported the ecosystem’s growth.

Resistance and Support Levels in $NEAR Price Action

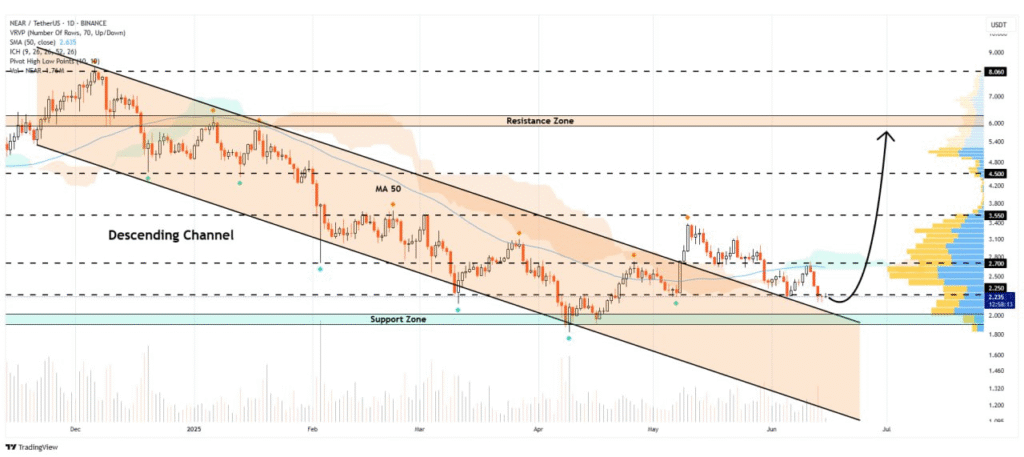

The price of $NEAR has been fluctuating within a descending channel, with key support near $2.25 and resistance around $4.50. Recently, the price tested the support zone, suggesting the potential for a rebound.

If the price manages to break above the $2.70 level, it could signal a move toward the resistance zone around $4.50. This level is further reinforced by the 50-day moving average (MA 50), which lies close to the resistance zone.

Should the price break the $4.50 resistance, higher targets ranging between $5.00 and $6.00 could be considered. On the other hand, failure to hold support at $2.25 could result in further downside risk, making the current price action crucial for determining the next major move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.