- Over 28% of Bitcoin’s circulating supply is now held at a loss.

- Bitcoin’s market sentiment is at extreme lows, signaling potential recovery.

- ETF outflows have reached $1.9 billion amid market panic.

Bitcoin’s market is experiencing a significant downturn, with nearly 28% of its circulating supply held at a loss. This represents about one-third of Bitcoin holders underwater. While the figure appears alarming, history suggests that such loss thresholds often coincide with market bottoms.

These levels have historically marked moments where selling pressure wanes, signaling the possibility of a recovery.

The extended period of price pressure has raised concerns among investors. As the price fluctuates below critical levels, more holders may feel inclined to exit the market, exacerbating selling pressure.

In many cases, these sellers are newer investors hoping to break even. Such behavior could potentially transform short-term recoveries into liquidity exits rather than the start of a fresh uptrend.

Liquidity Strain and Market Sentiment

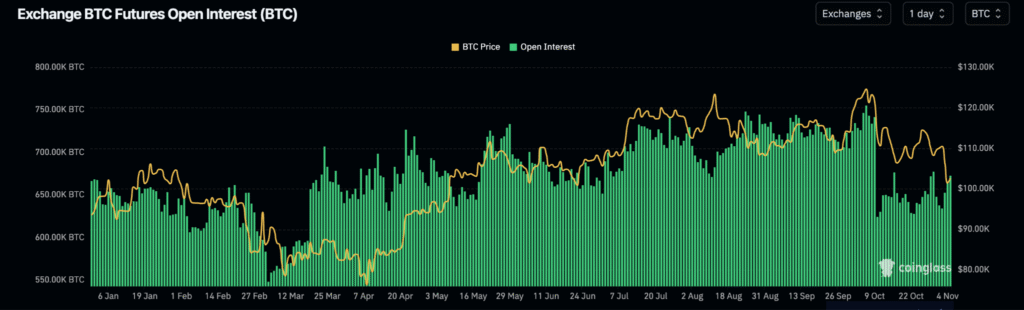

Bitcoin’s futures market has also witnessed a notable decline in open interest, which has decreased by 10% since Bitcoin’s peak in early October. This reduction in market participation suggests that fewer traders are willing to engage in positions, potentially making a return to previous highs more difficult.

A rise in open interest, ideally above 700,000 BTC, would serve as an early signal of a recovery.

In addition to futures market stress, Bitcoin-linked exchange-traded funds (ETFs) are experiencing significant outflows. Over $1.9 billion has been withdrawn from these ETFs, reflecting investor concerns and the overall panic in the market.

The combined assets in Bitcoin ETFs have dropped by 3%, a sign that investors are growing cautious amidst ongoing price drops.

Market at Extreme Fear Levels

The Fear and Greed Index for Bitcoin has recently hit a low of 20, the lowest since April, a time when Bitcoin prices bottomed around $82,000. Historically, extreme levels of fear in the market tend to serve as a contrarian signal, potentially indicating the end of a downturn and the beginning of a recovery phase.

Despite the challenges, Bitcoin’s resilience remains evident, as buying interest continues to surface near key price levels.

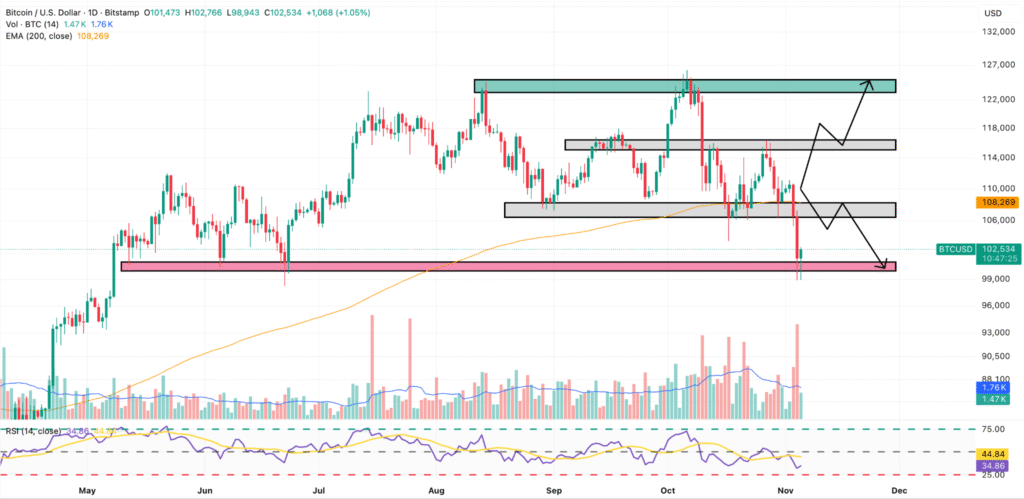

As Bitcoin remains above $100,000, the market seems to be testing whether it can sustain this floor. If it holds, it may signal that the worst of the pullback is over.

Yet, Bitcoin’s price is currently trading below the 200-day exponential moving average, a critical technical indicator. Should this level persist, further declines are possible, but if Bitcoin manages to recover, it could pave the way for a potential retest of the $108,000 mark, offering a promising upside for speculators.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.