The crypto market is gradually entering a maturity phase fueled by an essential industrial shakeout, signaling a healthier future.

Bitcoin emerged as a resilient digital currency and asset aiming to solve challenges associated with traditional financial systems. However, the digital assets industry has faced challenges as malicious actors capitalize on new crypto enthusiasts through fake or unclear investment projects. A new report by Alphractal points to an essential crypto industry shakeout that could impact Bitcoin and major altcoins.

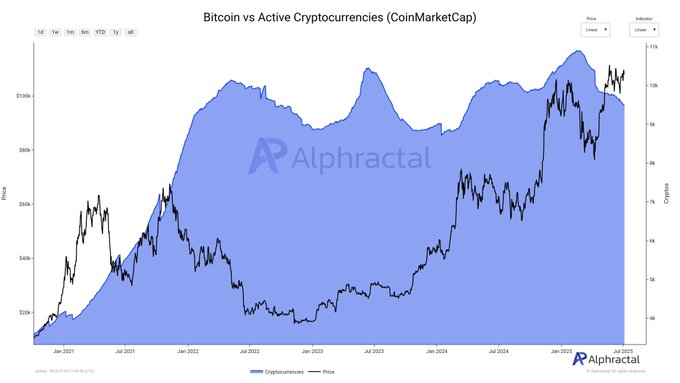

According to the report, Alphractal has tracked cryptocurrencies on CoinMarketCap daily, noticing that over 1400 altcoins have become inactive. Since 2021, the market has seen some hyped cryptocurrencies decline in market activity due to rug pulls, low volume, or delisting on major exchanges due to project abandonment. This is a significant cleansing phase where only quality projects survive the market shakeout.

A bullish reset for the crypto market?

While over 1400 coins going dormant sounds disappointing for the market’s activity, a decrease in low-quality projects accelerates industry maturity. For instance, the market could see a liquidity flow into useful and high-quality projects, thus advancing crypto adoption. Similarly, with fewer rug pulls in the market, investor confidence and institutional interest in the market could rise in the near term.

Major assets such as Bitcoin and blockchain-based utility tokens could see growth in market share alongside less competition for investor attention. The 2017 and 2021 bull cycles were associated with the disappearance of many speculative coins. Historically, the market cleansing is a liquidity flight into useful coins and fuel for crypto adoption in the mainstream digital economy. As a result, the market could see a major boom in the near term amid investor liquidity shifts.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their research before making financial decisions.