- PEPE holds strong support at $0.00001000, aiming for a breakout near $0.00001800.

- Rising futures open interest and bullish technical signals back PEPE’s price surge.

- Indicators suggest PEPE could rise further, targeting $0.00002800 if breakout is sustained.

PEPE is gaining attention in the crypto space, and its recent price action signals potential for a breakout. Technical indicators suggest a strong bullish setup, and the price is holding critical support while testing key resistance levels.

PEPE Price Analysis: 1-Day Chart

PEPE is forming a bullish breakout setup on the 1-day chart. The price currently trades at $0.00001213, testing the descending resistance trendline while holding solid support near $0.00001000.

The Relative Strength Index (RSI) is at 66, showing increasing buying interest. The tightening moving averages further suggest a possible trend reversal. A successful breakout above the resistance could drive the price toward $0.00001800, and potentially reach $0.00002800 in the longer term.

However, if the price fails to maintain support above $0.00001000, downside risks remain. Volume confirmation will be essential for validating the bullish outlook and determining the strength of the upward movement.

PEPE Price Analysis: 4-Hour Chart

On the 4-hour chart, PEPE shows significant upward movement after breaking past key resistance levels. A breakout near $0.00001136 pushed the price toward $0.00001162, a critical resistance zone.

The 7 and 21 EMAs have crossed above the 200 EMA, signaling bullish momentum in the short term. A buy order placed at $0.00001109 confirms potential support at lower price levels, reinforcing the strength of the current upward trend.

Volume spikes have accompanied the price increase, further confirming the bullish sentiment. Traders will be watching for a break above the $0.00001162 resistance as the next key price level to watch in the short term.

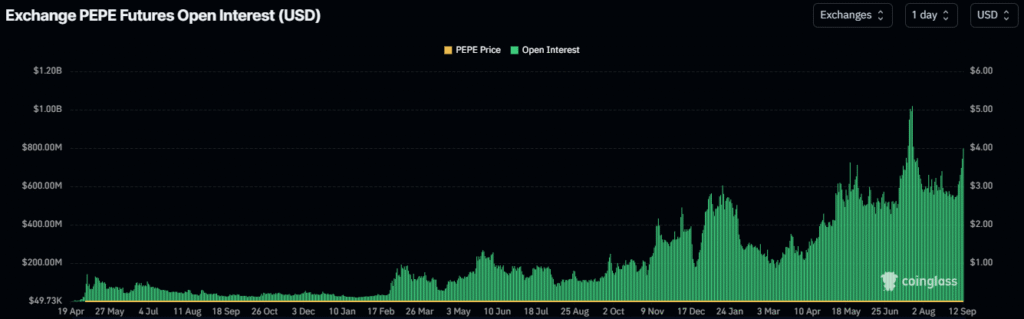

Rising Open Interest

Open interest in PEPE futures has been steadily climbing since April 19, 2024, with significant increases seen in May, June, and September. Conglass’s recent data show that open interest is approaching $1.2 billion, reflecting heightened speculative activity and growing investor engagement in PEPE.

This increase in open interest indicates that more investors are betting on the token’s future price movements, aligning with the strong price action seen on both the 1-day and 4-hour charts.

The rise in open interest is particularly notable given the strong technical signals suggesting further upward movement for PEPE. As the price climbs, increased futures activity points to a growing market confidence that the bullish trend could continue, pushing the token to higher levels in the near term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.