- Despite a slight 0.26% dip, Polygon (POL) maintained price stability, reflecting balanced trading activity and steady liquidity across exchanges.

- With all 10.528 billion tokens in circulation, Polygon (POL) operates in a demand-driven environment, minimizing inflationary risks and supporting consistent valuation.

- The ongoing transition from MATIC to Polygon (POL) strengthens its identity within Ethereum’s scaling ecosystem, reinforcing long-term network utility and adoption potential.

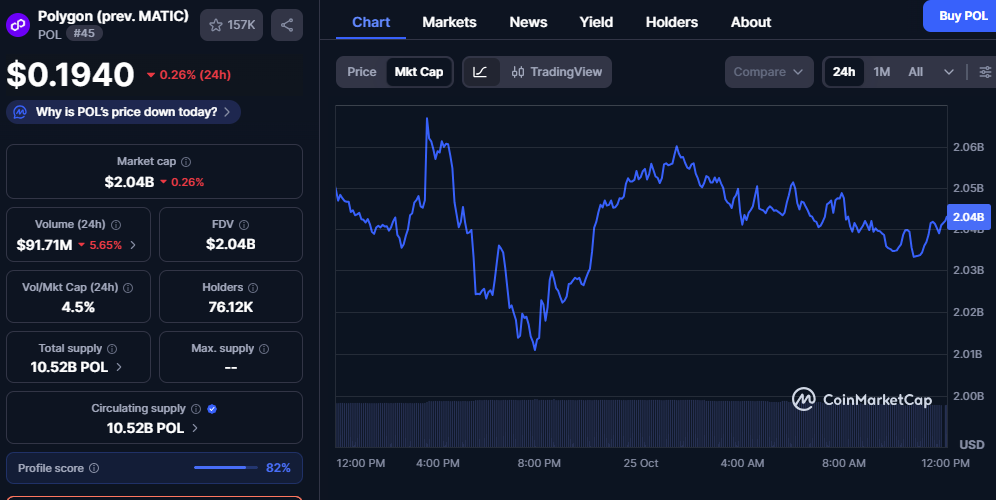

Polygon (POL) recorded a marginal 0.26% dip in the past 24 hours, trading at $0.1940. The token’s market cap stood at $2.04 billion, reflecting stable activity across exchanges. Despite minor movement, Polygon (POL) showed resilience, maintaining consistent value within a tight trading range.

The cryptocurrency experienced moderate volatility as market participants adjusted to broader crypto market conditions. Polygon (POL) sustained its position among top assets, supported by steady liquidity and active trading volumes. While slight pressure persisted, the asset remained within a balanced price zone.

Moreover, market behavior indicated consolidation, with fluctuations between $2.01 billion and $2.06 billion throughout the day. Polygon (POL) continued to trade sideways, reflecting balanced buying and selling pressure. This stability highlighted the network’s maturity and its ability to retain investor confidence amid market uncertainty.

Polygon (POL) Metrics Indicate Controlled Market Activity

Polygon (POL) displayed consistent fundamentals with a fully diluted valuation of $2.04 billion, equal to its market cap. All 10.528 billion tokens were in circulation, limiting inflationary risks and creating a transparent supply structure. This full circulation ensured that Polygon (POL) price movements relied primarily on market demand.

Source: Coinmarketcap

The token recorded $91.71 million in 24-hour trading volume, representing a 5.65% decline. However, the 4.5% volume-to-market-cap ratio suggested active participation despite lower turnover. Polygon (POL) retained strong engagement across its 76,120 holders, reinforcing network strength.

Furthermore, the network’s on-chain profile score of 82% reflected healthy ecosystem activity. Polygon (POL) maintained steady engagement levels, signaling sustainable long-term participation. This performance underlined its established market presence during broader sector adjustments.

Polygon (POL) Rebranding Strengthens Long-Term Outlook

Polygon (POL), previously known as MATIC, continued its rebranding transition with growing ecosystem integration. The rebrand aligned the token with Polygon’s scaling solutions, supporting its strategic evolution. Polygon (POL) maintained recognition as a vital component of Ethereum’s scaling infrastructure.

The 24-hour chart showed recurring recovery attempts after brief declines, indicating consolidation within a narrow range. Polygon (POL) demonstrated structural strength as it resisted deeper downward pressure. The consistent pattern suggested short-term equilibrium before potential directional shifts.

Overall, Polygon (POL) traded in a firm yet controlled manner, showing market stabilization after brief corrections. The token’s full supply, stable valuation, and steady demand pointed toward measured market confidence. Polygon (POL) remains positioned for steady performance as market volatility gradually subsides.