- Pump.fun Overtakes Hyperliquid – Pump.fun recorded $3.12M in daily revenue, surpassing Hyperliquid’s $2.78M and marking a turning point in adoption.

- Bearish Charts, Hidden Momentum – Despite bearish technical indicators, Pump.fun’s price gained 2.73%, hinting at possible bullish recovery signals ahead.

- New Economy Advantage – Pump.fun’s creator-driven model delivers rapid growth, challenging Hyperliquid’s traditional exchange model and reshaping the competitive landscape.

Pump.fun surpassed Hyperliquid in daily revenue on September 16, 2025. The platform recorded $3.12 million, while Hyperliquid earned $2.78 million. This marked a sharp change in market dynamics, showing a shift in user activity and revenue generation.

The momentum changed after several days of Hyperliquid dominance earlier in September. From September 7 to 11, Hyperliquid held the lead in revenue. However, between September 12 and 14, Pump.fun gained ground before taking the lead.

This milestone suggests strong adoption of Pump.fun’s model, which rewards creators directly. As a result, participation increased quickly, and revenues reflected this trend. Hyperliquid’s model, in contrast, remains dependent on traditional exchange activity.

Pump.fun Performance and Market Signals

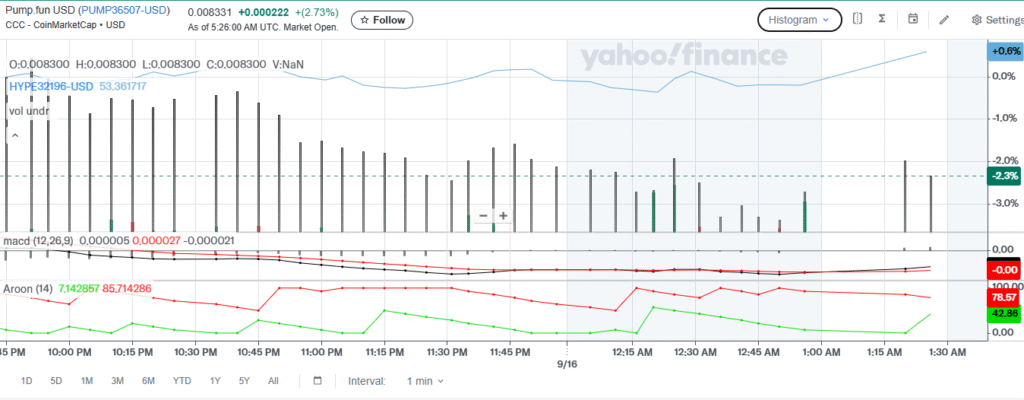

Pump.fun traded at $0.008331 with a gain of 2.73 percent during the session. The price movement showed steady but narrow progress. Despite low volatility, the upward direction reflected positive market interest during the trading snapshot.

Source: Yahoofinance

Technical indicators presented mixed signals. The MACD line stayed below the signal line, with a negative histogram pointing to lingering bearish momentum. Nevertheless, the gap narrowed, suggesting the potential for a bullish crossover if momentum continues.

The Aroon indicator reinforced a bearish outlook. Aroon Down stood at 78.57, while Aroon Up measured 42.86. This imbalance revealed stronger downward pressure, although improvements appeared possible if Aroon Up rises further.

Hyperliquid Context and Competitive Outlook

Hyperliquid operated under a traditional exchange-driven model, earning revenue primarily from trading fees. This structure relied on consistent user trading activity across a wide base. However, it lacked the direct creator incentives fueling Pump.fun’s rapid growth.

While Hyperliquid held steady revenue performance, Pump.fun’s surge reflected new trends. Individual creators captured large earnings, showcasing the appeal of the platform. This engagement highlighted how finance and entertainment continued to overlap in emerging crypto ecosystems.

If Pump.fun sustains its trajectory, it may reshape competition by year-end. The platform already demonstrated scalability through creator rewards and viral activity. Hyperliquid must adapt or risk losing relevance in an evolving digital market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.