- The wallet linked to the Rollbit Treasury remained inactive for two years and sold at $203.4, capturing near-peak market conditions and realizing $10.17 million.

- Acquired when Solana was just $24.6, the 50,000 SOL allocation grew from $1.23 million to over $10 million, securing nearly $9 million in profit.

- The sale raised questions about Rollbit’s distribution strategy and highlighted how treasury-linked wallets influence market sentiment and short-term price dynamics.

A wallet linked to the Rollbit Treasury sold 50,000 SOL after two years of inactivity. The liquidation happened when Solana traded at $203.4, generating $10.17 million. The transaction marked one of the largest treasury-linked movements in recent months.

The wallet originally received the 50,000 SOL from the Rollbit Treasury two years earlier. At that time, Solana traded near $24.6, valuing the tokens at about $1.23 million. The sale has now turned that allocation into nearly $9 million in realized profit.

Such timing highlighted deliberate strategy and patience. The wallet remained inactive until favorable conditions returned, then exited during a strong market upswing. This reinforced the impact that large, silent holders can have once they re-enter trading activity.

Solana’s Price Movements

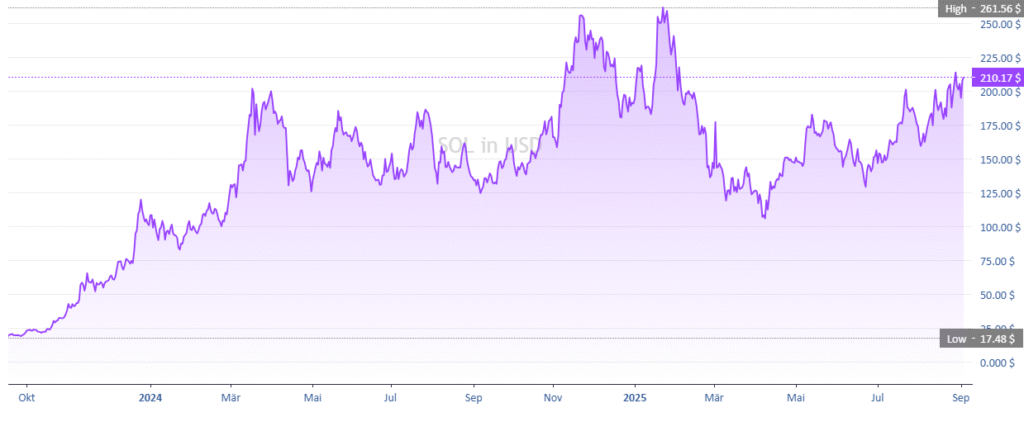

Solana has been very fluctuating in the last two years. The token fell as low as 17.48 in end-2023 and then started recovering. It had already passed through essential levels by the beginning of 2024 and indicated a new strength.

During mid-2024, Solana traded between $100 and $175 with several failed breakout attempts. Consolidation defined this period as the market absorbed earlier gains. Such swings set the stage for larger moves that came later in the cycle.

The largest rally came between late 2024 and early 2025. Solana surged to $261.56 before correcting below $125. By September 2025, it recovered strongly and stabilized near $210.

Market Implications

The sale raised questions about Rollbit’s treasury management. If linked to team allocation or incentives, the transaction could reflect insider liquidity decisions. Large disposals often spark discussion regarding timing and intent.

Solana’s liquidity helped absorb the sale, but such events can create short-term pressure. Market participants often interpret treasury-linked movements as signals. These transactions reveal patterns of confidence or caution from key holders.

Blockchain transparency enabled the public to track the sale in real time. Such visibility strengthened awareness but also highlighted treasury-linked influence. The event emphasized how significant wallet movements affect market perception.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.