- $SEI’s TD Sequential indicator has flipped to a buy signal, suggesting bullish momentum.

- Trading volume for $SEI doubled in the past 24 hours, indicating increased market interest.

- Sei Network is positioning itself as a key player in global finance with new features like Chainlink Data Streams.

$SEI Signals Bullish Momentum: TD Sequential Indicator Flips to Buy

The recent technical analysis of $SEI has shown a strong potential for a bullish movement. On September 21, the TD Sequential indicator, a popular tool among traders, flashed a “9” signal at the top of the price chart, marking a potential reversal point after a clear downtrend.

This is often interpreted as a signal that a shift in market direction is possible. After a brief pullback, the indicator showed a “buy” signal on September 23, further supporting the idea of a bullish trend.

The TD Sequential indicator works by identifying price exhaustion points. The appearance of a “9” on the chart suggests that the selling pressure may be waning, and a price reversal could be imminent.

With the buy signal now in play, there is growing speculation that $SEI could experience a price increase in the near term. At the time of writing, $SEI is priced at $0.28947.

Surge in Trading Volume Indicates Market Interest

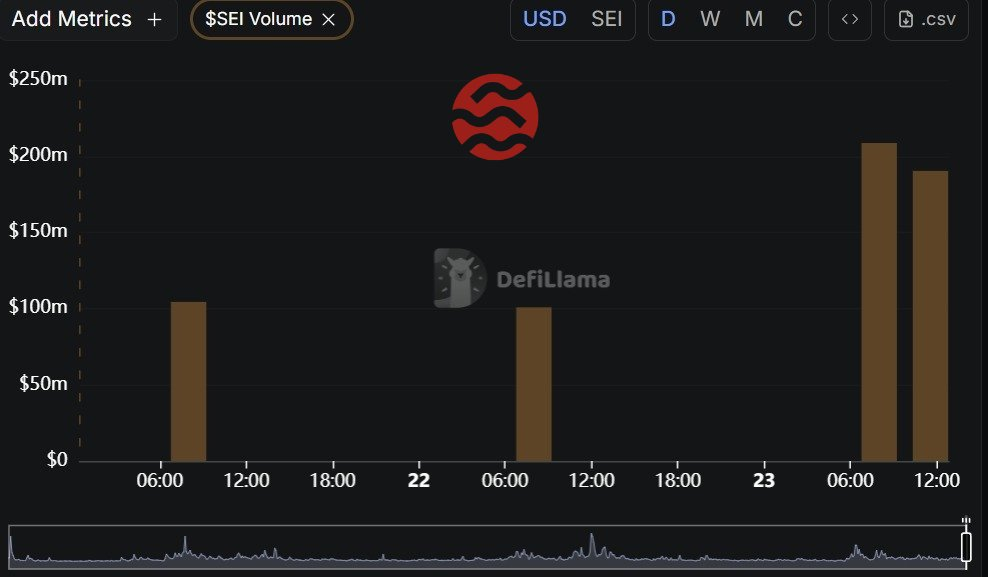

Another important factor contributing to the growing optimism around $SEI is the dramatic surge in trading volume. DeFiLlama data shows that $SEI’s trading volume doubled in the past 24 hours, with significant spikes observed on September 22 and 23.

The most notable increase in trading activity occurred around 06:00 on September 23. This surge suggests heightened investor interest in the asset, likely driven by recent developments in the Sei Network and broader market trends.

The increase in volume often signals a shift in investor sentiment, with more people entering the market. Analyst Marc Shawn Brown commented on the data, suggesting that the rising volume could be tied to increased awareness of Sei Network’s growing role in global finance.

Sei Network’s Vision for Global Finance

Sei Network has outlined its vision for expanding its role in global finance. The platform aims to be the preferred settlement layer for financial transactions, emphasizing the importance of speed and stability.

Recent updates, such as Chainlink Data Streams and PayPal’s Native Stablecoin, are seen as crucial for improving transaction efficiency and attracting institutional investors. Analyst Ali Martinez noted that Sei Network’s technical developments could significantly boost its market relevance.

As more institutions seek stable and fast financial platforms, Sei’s ability to offer such services could pave the way for broader adoption. This strategic positioning may not only support $SEI’s price growth but also help the network solidify its place in the growing decentralized finance ecosystem.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.