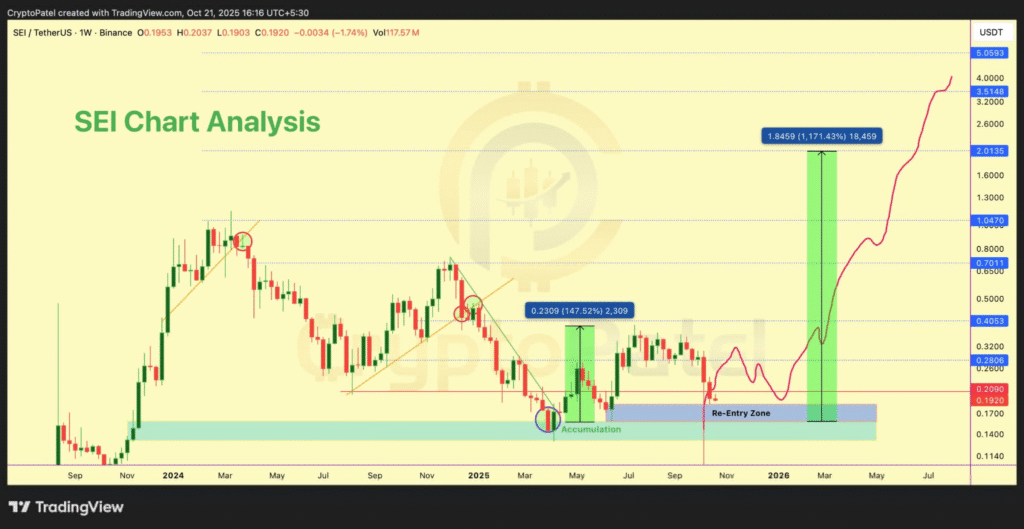

- SEI trades near $0.19, showing signs of accumulation between $0.16–$0.20.

- A breakout above $0.30 may confirm reversal, targeting $0.44 short term.

- Analysts note SEI’s pattern mirrors past setups before sharp rallies.

SEI continues to trade within a key support zone near $0.19, indicating a potential short-term recovery. Market analyst Ali Martinez noted that maintaining this area could lead to a rebound toward $0.31 with an extended target near $0.44, based on current chart projections from TradingView.

The recent price behavior indicates that SEI has reached the lower boundary of an ascending channel, where past movements have shown signs of recovery. Traders are now watching this zone for confirmation of buying interest that could stabilize price action.

Accumulation Range Suggests Renewed Buying Interest

Analyst Crypto Patel referred to the $0.16–$0.20 range as a “Re-Entry Zone.” This level previously acted as a foundation for substantial upward moves earlier in 2025. After months of decline, SEI’s price has returned to this historically active area where institutional buyers accumulated before a major rally.

Market data shows consistent absorption of supply around this range, suggesting accumulation behavior. If the asset holds above $0.19 and achieves a sustained close beyond $0.28–$0.30, analysts believe this could confirm a short-term reversal and attract momentum traders.

The current structure also reflects a symmetrical pattern that often appears before expansion phases. Some analysts project possible moves toward $1.00–$3.50 over the coming quarters if market conditions align.

Outlook Based on Technical Structure

The broader chart setup suggests that SEI may have completed a full market cycle and is now entering a new phase of expansion. While near-term price action depends on volume strength, technical indicators point to renewed interest from buyers.

Traders continue to monitor resistance levels around $0.30, which remain critical for confirming any bullish continuation. The next few weeks are expected to determine whether SEI’s support zone can sustain a meaningful rebound and trigger the next upward move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.