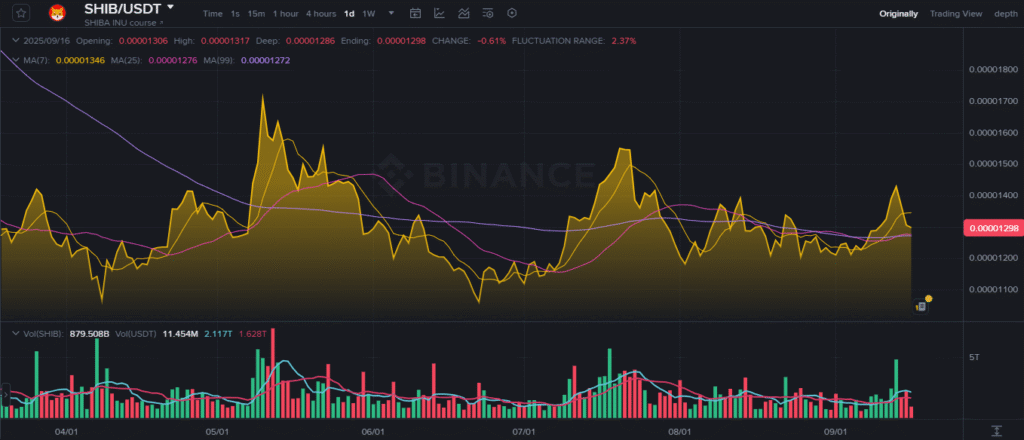

- 0.0000127 is the hinge — SHIB holds above the 25/99-day confluence; a daily close below it weakens the budding uptrend.

- Trigger then travel — Reclaiming the 7-day near 0.00001346 unlocks 0.0000135, then 0.0000139–0.0000142 if volume expands.

- Timeframe mix — Monthly trendline from 2022 stays intact while RSI hints divergence; rising Stoch RSI needs confirmation above 20.

Crypto markets start the week with steady expectations and tight ranges. Bitcoin eases intraday while Shiba Inu defends a key shelf. Therefore, policy signals and liquidity will likely guide the next push.

Bitcoin opened firm, but price faded from intraday highs and settled softer. Volume expanded early and then tapered, which often marks balance. Consequently, the tape now trades inside a contained range ahead of the decision.

Momentum indicators reflect that cooling shift. MACD rolled toward the zero line and the histogram turned small and mixed. Moreover, Aroon Up weakened while Aroon Down rose, which implies more frequent lows than highs.

Levels remain clear for short-term structure. Support sits near recent bounce zones, while resistance clusters near the last failed push. A base and break above nearby caps would be required to reassert upside traction.

Shiba Inu (SHIB)

SHIB closed near 0.00001298 with a modest daily decline. The session’s range stayed near 2.4 percent, which signals consolidation. Importantly, price still holds above the 25-day and 99-day moving averages.

Medium trend signals show early improvement. The 25-day average has crossed above the 99-day and both are curling gently higher. Therefore, the 0.0000127 cluster has become a pivotal shelf to monitor.

Source: Binance

Short-term momentum now needs confirmation. Recent green volume spikes backed rallies, yet activity eased as price stalled near 0.0000130. Without stronger participation, price tends to chop around the short average.

Upside markers sit overhead. A daily close back above the 7-day average near 0.00001346 would open 0.0000135 first. If follow-through develops, 0.0000139 to 0.0000142 becomes the next objective.

Downside risks remain defined. A close beneath the 25-day and 99-day band would weaken the budding upturn. That failure could invite tests of 0.0000122 and then 0.0000118.

Monthly Framework for SHIB

The monthly chart still holds an ascending trendline from 2022. That rising base shows buyers defending progressively higher levels despite pullbacks. Thus, the broader setup stays constructive while monthly closes remain above that line.

Oscillator readings add nuance. The displayed RSI appears lower while price held a higher range, which can mean bearish divergence. By contrast, the Stoch RSI turns higher from oversold and signals possible multi-month recovery energy.

Confirmation remains essential for trend. A %K/%D cross that sustains above 20 would strengthen the bullish momentum view. Additionally, a monthly close through the prior pivot high would validate continuation.

Overall, SHIB’s path hinges on the 0.0000127 stair step. Holding that shelf keeps the constructive bias intact and aids a grind higher. Losing it would shift momentum and raise the risk of a deeper retrace.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.