- Shiba Inu’s burn rate has increased by 324% this month, yet the effect is minimal.

- Despite bullish consolidation, SHIB faces challenges in reaching its all-time high.

- The memecoin market, including SHIB, struggles to sustain momentum as 2025 progresses.

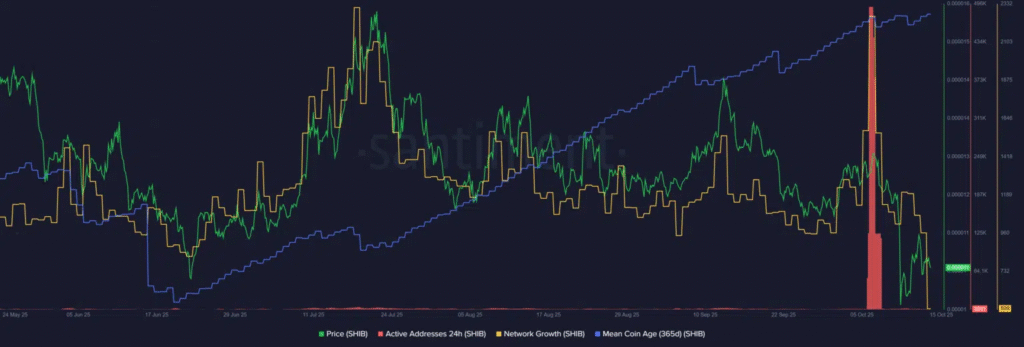

Shiba Inu (SHIB) has been consolidating near the $0.000010 zone, with key support levels being actively defended by bullish traders. The 4-hour chart suggests a potential double-bottom formation, indicating the possibility of a reversal toward the $0.0000135 level. The ongoing consolidation could set the stage for a breakout, but the memecoin’s future price movement is far from certain.

Shiba Inu’s Burn Mechanism and Network Growth

Shiba Inu has maintained its burn mechanism, with 36.222 million tokens burnt this month. Although the daily burn rate has surged by 324%, the total amount burned this month amounts to only $362, a minimal impact given the coin’s massive supply.

Additionally, the mean coin age has been rising since June, signaling network-wide accumulation as long-term holders continue to HODL. However, the daily active address growth has been subdued, with only a brief uptick in activity earlier this month.

Despite these positives, SHIB faces headwinds in terms of network expansion. New address creation has slowed, and the memecoin market has struggled to regain the euphoria seen in late 2024. The token’s popularity among retail investors remains a key factor, but its price will likely depend on broader market sentiment.

Can SHIB Reach $0.01? Assessing the Possibility

The $0.01 price target for SHIB remains an aspirational goal for many investors, but it seems increasingly out of reach in the current market cycle. With a total supply of 589.5 trillion tokens, SHIB would need to see an astronomical market cap to reach $0.01. This would require a $6 trillion valuation, far beyond the $1.53 trillion total market cap of all altcoins.

While some hope for a long-term rally, the memecoin market, including SHIB, has experienced a significant contraction since December 2024, when its market cap reached $24.27 billion. Currently, the market cap stands at just $8.7 billion, underscoring the difficulty in achieving such lofty price targets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.