- SHIB exchange reserves drop below 100T, easing short-term sell pressure.

- Shibarium processes 1.72M daily transactions, showing growing user activity.

Shiba Inu’s Layer-2 solution, Shibarium, is nearing a historic transaction count as it approaches the 1 billion mark. The network has shown sharp growth in usage, with millions of transactions recorded daily. This surge comes as SHIB faces price pressures in a volatile market. Burn rate spikes and reduced exchange reserves also raise hopes for a possible price rebound.

Shibarium Closes in on 1 Billion Transactions

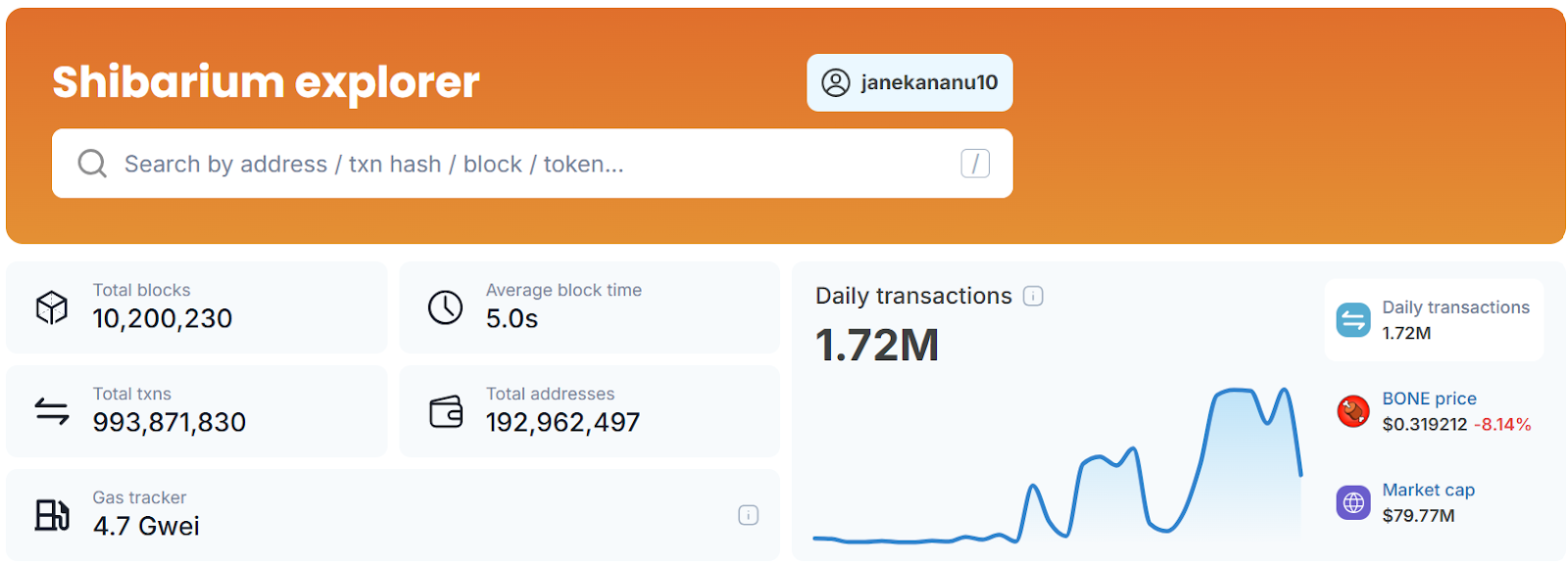

According to ShibariumScan, Shibarium, the Layer-2 blockchain for the Shiba Inu ecosystem, has now processed over 993 million transactions, with fewer than 7 million remaining to hit the 1 billion mark. Daily activity stands at 1.72 million transactions, showing consistent network use.

The network has produced over 10.2 million blocks, and total addresses have reached nearly 193 million, indicating steady growth. Developers plan to expand Shibarium into a roll-up hub, allowing Layer-3 rollups to settle on the network using BONE as gas.

Burn Rate Surge Points to Potential Price Recovery

Recent market data reported by CoinCryptoNews shows a 495.55% increase in Shiba Inu’s burn rate over the past 24 hours. Over 14 million SHIB tokens were removed from circulation in that period. This burn activity brings the total permanently removed supply to 410.74 trillion SHIB.

The circulating supply now stands at roughly 584.35 trillion tokens. Despite SHIB falling 1.37% recently, analysts see the burn spike as a sign of shifting sentiment. CoinCryptoNews also highlighted that 36.95% of holders remain profitable, reflecting continued community support.

Exchange Reserves Hit Record Lows

SHIB’s exchange reserves have dropped to 98 trillion, marking a new historic low, according to CryptoQuant. This amount represents a smaller portion of the total circulating supply, indicating sustained withdrawal activity. The trend suggests that holders are moving SHIB out of centralized exchanges and into long-term storage, which may ease immediate sell pressure.

Back in April 2022, reserves stood at approximately 200 trillion SHIB. By February 2024, that figure had decreased to 165.8 trillion. The current level below 100 trillion further confirms a consistent decline, reinforcing the view that many SHIB holders are positioning for the long-term

Despite the drop in exchange reserves, SHIB’s market cap stands at $7.48 billion, with a current price of $0.00001269. The 24-hour trading volume declined by 11.72% to $187.21 million. Analysts monitor whether the continued reserve shift and elevated burn rate can support a potential bounce as market conditions remain bearish.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.