- Forward Industries holds 6.8 million $SOL and plans to launch tokenized shares.

- Solana’s $213 support level is critical as traders anticipate a potential reversal.

- Analysts monitor $SOL’s price action, with $213 crucial for the next movement.

Forward Industries to Launch Tokenized Shares on Solana

Forward Industries recently announced that it intends to launch tokenized shares on the Solana blockchain. The launch will occur through Superstate’s Opening Bell, marking a notable step in the company’s use of blockchain technology.

As one of the largest treasury holders of Solana’s $SOL, Forward Industries currently holds around 6.8 million $SOL. This move could potentially add new dimensions to the way tokenized shares are traded. With this announcement, Solana is positioned to become a significant player in the tokenized assets space.

The company’s focus is on integrating blockchain’s benefits with the established world of securities and asset management. In doing so, Forward Industries could set a precedent for other companies looking to digitize their assets and increase transparency in trading.

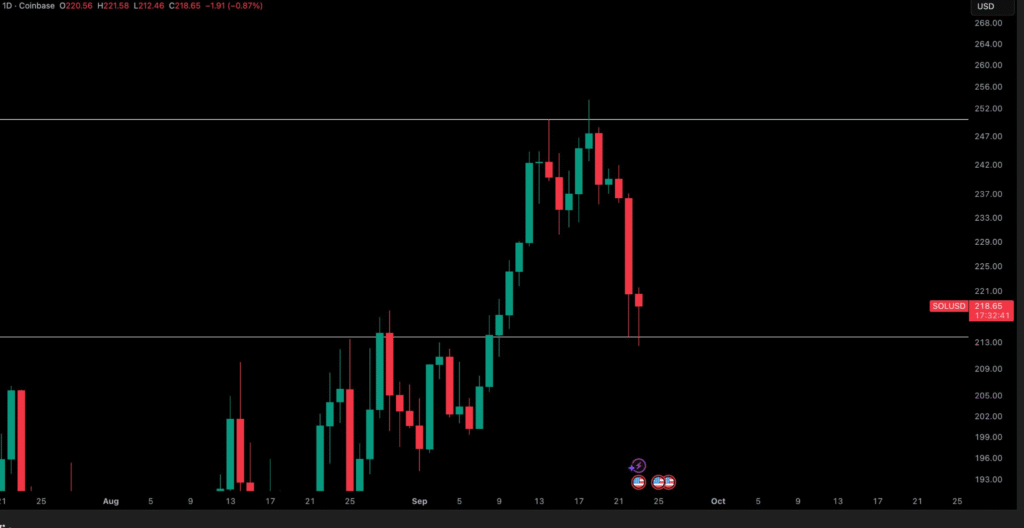

$SOL/USD at a Critical Crossroad

For traders and investors monitoring Solana’s price movements, the $213 level has become a point of intense focus. CryptoTony’s analysis shows that many are watching how $SOL performs at this support zone. The price recently faced a sharp decline from the $247 level, signaling a potential pullback.

Tony said the $213 mark is being tested to determine if it can hold strong as support. If this level fails to hold, analysts predict the possibility of a deeper drop, adding pressure to $SOL’s near-term performance.

In the coming days, the $213 price point could be key in deciding whether $SOL will see a rebound or continue to face downward momentum. Traders and market participants are closely watching for a confirmation of this level’s strength.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.