- Stablecoins’ market cap reaches $236B, surpassing Ethereum, with Tether leading at $143B.

- Tether’s on-chain activity spikes, signaling increased market participation and potential crypto rebound.

Stablecoins have surpassed Ethereum in total market capitalization, reaching $235.7 billion, according to CoinGecko. Tether (USDT) remains the dominant stablecoin, accounting for $143.3 billion of the total.

The surge in stablecoin activity comes amid increased adoption and regulatory clarity. Meanwhile, Tether’s on-chain activity has spiked to a six-month high, with over 143,000 daily transfers, suggesting heightened market participation.

Tether’s On-Chain Activity Reaches Record High

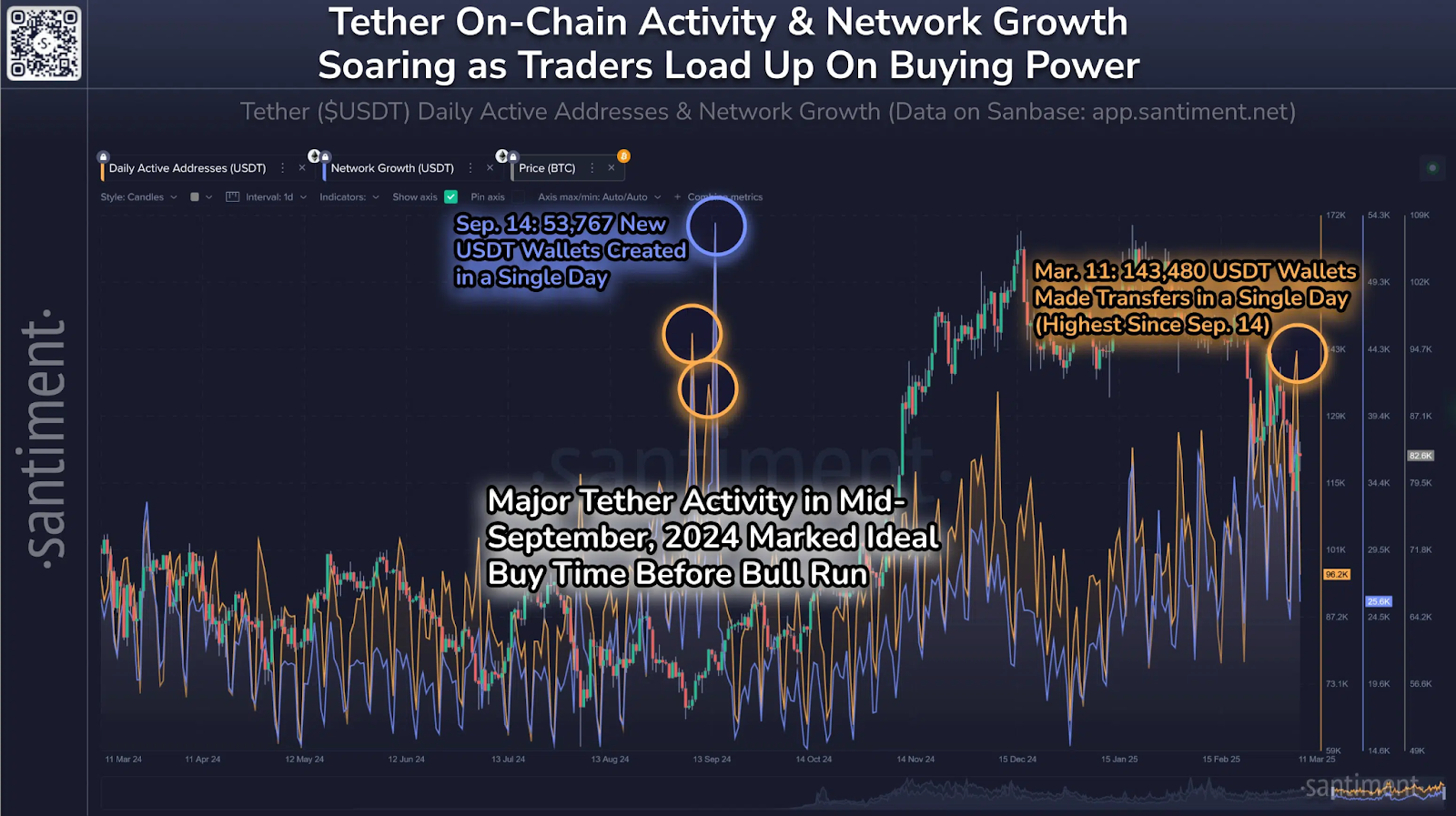

Data from Santiment shows that Tether’s daily active addresses reached 143,480, marking the highest level in six months. This surge in network activity signals growing demand and increased blockchain usage. The USDT Network growth metric also indicates a rise, suggesting broader adoption.

Historically, spikes in Tether’s on-chain activity have coincided with periods of price volatility in the crypto market. Analysts note that similar trends in September 2024 preceded a price recovery. Market watchers suggest that heightened USDT transactions could indicate traders preparing for a potential market rebound.

Stablecoins Surpass Ethereum’s Market Capitalization

The total stablecoin market cap has exceeded $236 billion, surpassing Ethereum’s $226.3 billion valuation. USDT remains the leader, followed by USDC at $58.3 billion and DAI at $3.2 billion. Stablecoins now account for a significant share of the crypto market, reflecting their growing role in digital finance.

Regulatory developments have also played a role in this shift. Tracy Jin, COO of MEXC, told FXStreet that the lifting of OCC restrictions in the U.S. has reduced barriers for banks engaging with stablecoins. Additionally, the U.S. Treasury’s stance on stablecoin integration has further legitimized their role in mainstream finance.

In Asia, Thailand and Japan have expanded stablecoin adoption, with USDT now officially recognized on regulated exchanges. This increased access has bolstered liquidity, making stablecoins a preferred asset for cross-border transactions.

Market Outlook: Is Crypto Set for a Rebound?

Despite the surge in stablecoin usage, the broader crypto market remains under pressure. Bitcoin and altcoins have declined, with market sentiment reflecting uncertainty. The recent $3.5 billion outflow from Bitcoin ETFs indicates a shift in investor positioning toward stable assets.

Jin noted that if macroeconomic conditions remain unfavorable, capital could continue flowing into stablecoins as a safe haven. However, if positive regulatory or institutional developments emerge, crypto prices could rebound, fueled by stablecoin-backed liquidity.

As we discussed earlier on Coincryptonewz, stablecoins are evolving beyond trading pairs and are increasingly used for remittances, corporate treasury management, and cross-border payments. This shift could redefine the role of stablecoins in the global financial ecosystem.

With Tether’s on-chain activity at record levels, analysts are watching for signs of a market recovery. If historical patterns hold, the rise in stablecoin transactions could indicate renewed buying pressure in the crypto market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.