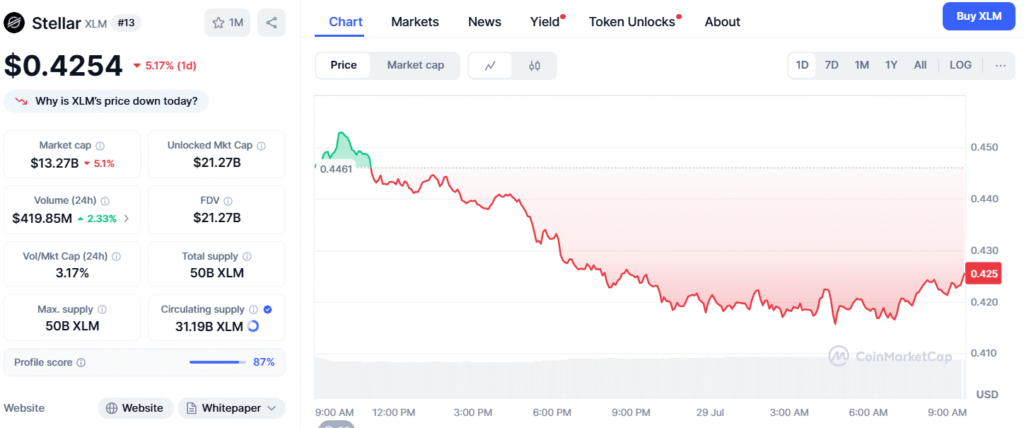

Stellar ($XLM), the 13th-ranked cryptocurrency by market cap, is grappling with a significant technical setback.

According to a recent analysis by crypto expert Ali @ali_charts on X, $XLM has lost its 10-day Simple Moving Average (SMA) as support, a critical indicator for traders. Priced at $0.4224 USD with a 24-hour trading volume of $427 million as of July 23, 2025, this breach suggests potential bearish momentum if the price remains below this level.

The accompanying chart highlights a bear flag pattern, a formation often signaling a continuation of a downward trend, adding weight to the bearish outlook.

Technical analysis from Investopedia indicates that losing the SMA, particularly longer-term averages like the 50-day or 200-day, can foreshadow declines, with historical data showing a 70% likelihood of a drop over the next month following such a break. While the 10-day SMA is a shorter, more volatile indicator, its loss still warrants caution. The bear flag pattern, recognized by Tokenmetrics with a 65% success rate in predicting downward trends, further supports this analysis. This pattern emerges after an initial price drop, followed by a consolidation phase, and a subsequent decline—precisely what the chart depicts.

External factors may also be at play. The recent U.S.-EU trade deal, finalized on July 27, 2025, introduced a 15% tariff on EU goods, injecting uncertainty into global markets. Such macroeconomic shifts often influence cryptocurrency prices, potentially exacerbating $XLM’s current vulnerability. Traders are now watching closely for a reclaim of the 10-day SMA, which could signal a bullish reversal, or a deeper correction if support fails.

For now, $XLM’s fate hinges on its ability to regain technical strength amid broader market dynamics. Investors are advised to monitor volume trends and key support levels, as the next few days could determine whether this is a short-term pullback or the start of a more significant downturn.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.