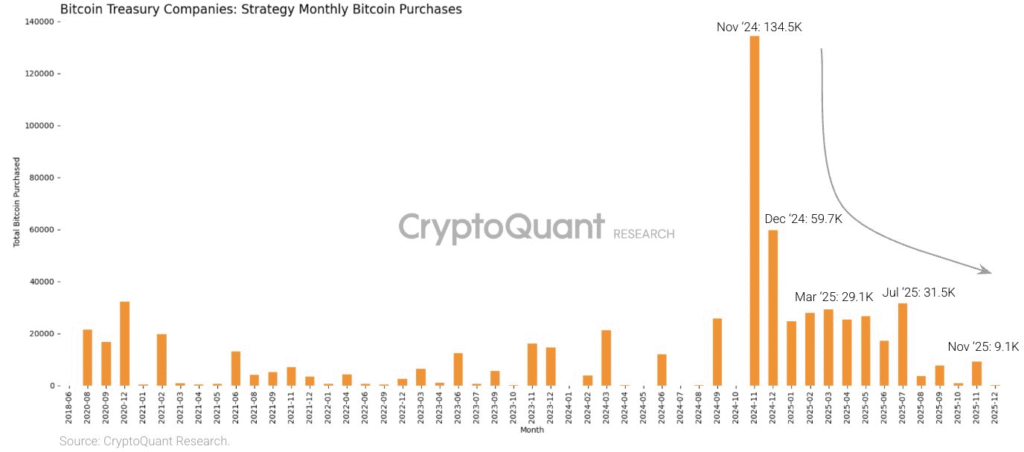

- Strategy’s Bitcoin purchases fell from 134K BTC in Nov 2024 to just 9.1K BTC in Nov 2025.

- The firm holds 650,000 BTC worth $60 billion, accounting for 3.1% of total Bitcoin supply.

- Strategy created a $1.44 billion reserve to cover its debt and preferred stock obligations.

Bitcoin’s largest corporate holder, Strategy, has drastically reduced its Bitcoin purchases in 2025. According to CryptoQuant, the company has shifted from aggressively accumulating Bitcoin to barely purchasing any. This sudden change has raised questions about the long-term sustainability of Strategy’s holdings and whether the firm will have to make significant changes to its investment strategy.

A Significant Drop in Purchases.

At the height of Bitcoin’s bull market in November 2024, Strategy purchased 134.5K BTC. However, by November 2025, the firm’s monthly Bitcoin purchases dropped to just 9.1K BTC.

The trend continued into December, with only 135 BTC bought, marking one of the weakest months in years. This shift reflects a broader trend of reduced buying pressure from large institutional investors, further compounded by a more cautious approach in the wake of the ongoing market downturn.

“Public companies can and do completely implode,” stated Eli Cohen, corporate lawyer for Centrifuge. “Enron, Lehman Brothers, and recently banks like Silicon Valley Bank have all seen such failures. No company, no matter how large, is too big to fail.”

Strategy’s move to scale back its Bitcoin buying has been seen as a necessary step to maintain its stability, but it is also raising alarm bells about the firm’s financial resilience.

Strategy’s Financial Strategy to Secure Cash Flow

Amid growing concerns over its financial stability, Strategy has created a $1.44 billion reserve to cover its obligations. The reserve is designed to ensure that the company can meet its dividend payments and interest on its outstanding debt for at least 12 months.

To extend this cushion to 24 months, the firm plans to safeguard its long-term financial health by keeping enough liquidity on hand.

Despite the cautious approach to its Bitcoin purchases, Strategy’s total holdings still amount to 650,000 BTC, which is valued at roughly $60 billion, accounting for 3.1% of Bitcoin’s total supply. This substantial holding places the firm in a powerful position, but its decision to slow its Bitcoin accumulation has been met with both internal and external scrutiny.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.