- SUI trades at $2.45 with strong support at $2.35 and resistance at $2.47.

- Canary updated its SUI ETF filing, confirming Cboe ticker coordination.

- Monthly chart shows a bullish setup with a possible breakout toward $9.

Sui (SUI) is gaining attention after showing strong technical signals and renewed interest from ETF developments. Prices are holding within a key range, and analysts are pointing to a possible breakout. The token has also entered the ETF spotlight, with Canary Funds updating its SEC filing for a spot SUI ETF.

Price Action Holds Key Support and Resistance Levels

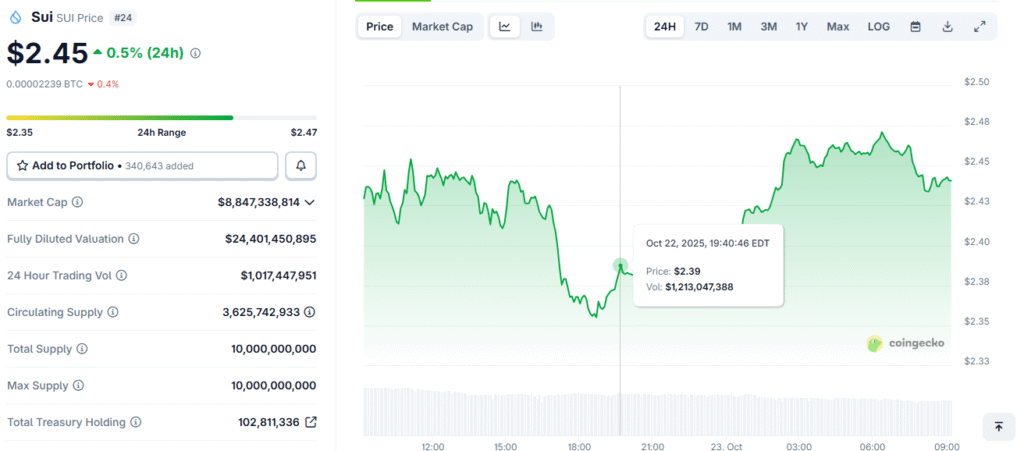

Sui (SUI) is trading at $2.45, up 0.5% in the past 24 hours, according to CoinGecko. The current 24-hour price range shows support at $2.35 and resistance at $2.47. The trading volume over the past 24 hours exceeded $1 billion, indicating active interest despite recent fluctuations.

SUI remains inside this narrow range and a breakout above $2.47 may indicate short-term bullish continuation. However, confirmation would depend on sustained volume and broader market conditions.

Bullish Chart Patterns Signal Recovery Potential

The monthly chart of SUI shared by analyst Suinter reveals a long-term descending trendline. Price action has consistently bounced from a key support zone near $0.66. This has formed a bullish base, and a breakout above the trendline may lead toward a potential target of $9.

Additionally, analyst Sjuul from AltCryptoGems noted a bullish divergence on the RSI from the daily chart. The divergence aligns with a bounce from the range low. Previous moves from this level have returned to the range high, supporting the idea of a technical recovery.

ETF Filing Places SUI in Institutional Spotlight

Canary Funds has submitted a revised S-1/A filing with the U.S. Securities and Exchange Commission (SEC) for its Spot SUI ETF. The update includes minor administrative changes and confirms ongoing coordination with the Cboe exchange. This step reflects operational progress and market preparation.

The filing update was shared by the Sui Community on X and has brought renewed investor attention to the asset. Analysts suggest the development could increase exposure of SUI in traditional markets, attracting broader institutional and retail interest, even as the approval process remains ongoing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.