- SUI price grew 13% in a week, reaching $1.50 amid a sharp drop in TVL.

- SUI’s DeFi TVL declined from 889M to 661M tokens since October 25.

- DEX volumes on Sui near the lowest point in five months by end of November.

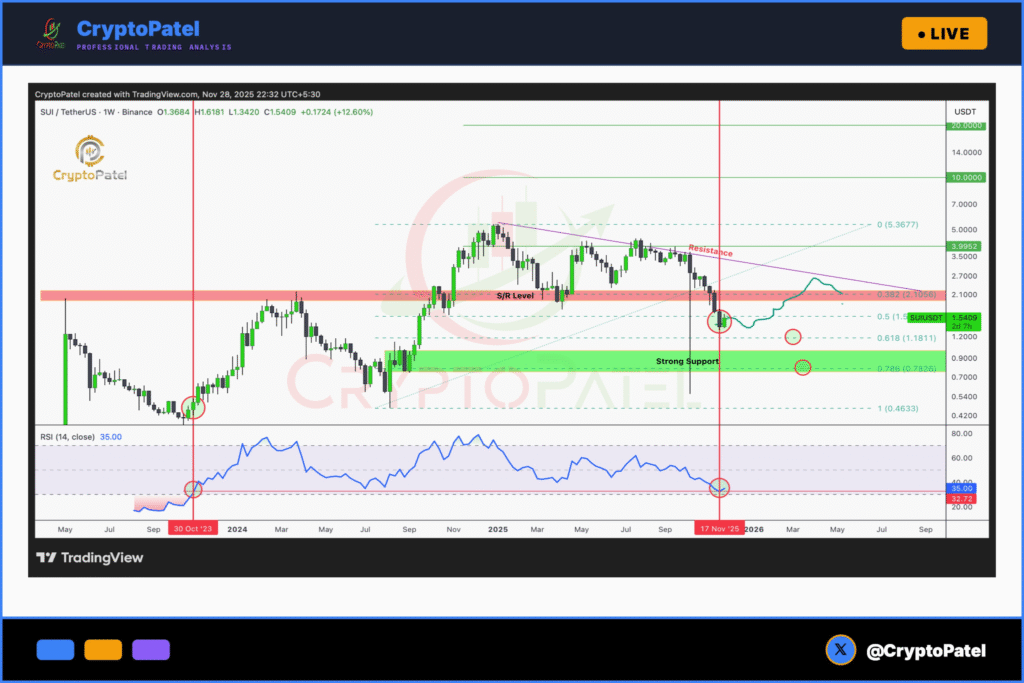

SUI Rebounds to $1.50 as RSI Points to Potential Reversal

Sui (SUI) has gained nearly 13% over the past week, trading at $1.50 on November 29. The price increase comes after a strong decline that brought the token to oversold territory on the weekly Relative Strength Index (RSI), signaling a potential trend change.

According to analyst Crypto Patel, SUI bounced near the 0.618 Fibonacci retracement level, a commonly watched technical point. Patel noted that the weekly RSI has reached its most oversold level since early 2023, which could point to a possible price reversal.

He identified a support zone on the chart and stated that short-term price targets may reach $2.2 to $3. He also said that macro targets could extend to $10–$20, depending on the strength of the recovery. Patel advised, “Not financial advice. Do your own research.”

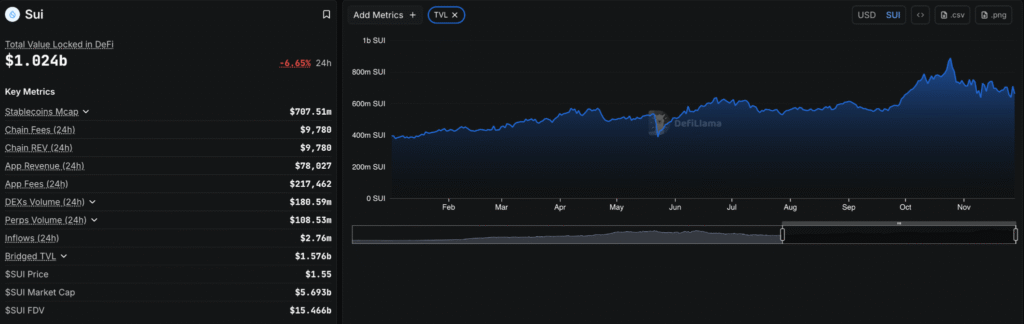

TVL and DEX Volumes Reflect Bearish Sentiment

DeFi Llama data shows a 25% drop in the total value locked (TVL) in Sui’s decentralised finance (DeFi) ecosystem. The TVL fell from 889 million SUI tokens on October 25 to 661 million as of late November.

This decline aligns with the market’s reaction following the U.S. Federal Reserve’s last meeting, where concerns were raised about a third-rate cut in 2025.

Data from DeFi Llama shows that the drop in TVL reflects investor caution during the recent selling phase. The network’s DEX volumes are also set to record their lowest monthly level in five months, suggesting reduced trader participation.

Despite the price recovery, the lower activity across DeFi platforms may weigh on broader sentiment. However, technical traders are watching closely for continued support near current levels.

Market Outlook and Technical Setup Remain in Focus

The current rebound is seen by some market watchers as part of a technical correction rather than a full trend reversal. The bounce from the Fibonacci level, combined with the oversold RSI, suggests potential short-term momentum.

Whether this recovery extends depends on holding the current support. Analyst projections and increased trading volume suggest renewed interest, but the drop in TVL and DEX volumes continues to show caution.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.