- Bitmine’s Ethereum holdings now exceed 3.126 million valued at $12.47B.

- Whale orders near $4,000 show growing institutional accumulation activity.

- Ethereum trades around $3,976 consolidating below the key resistance level.

Ethereum whales are showing renewed confidence as major institutional players continue accumulating large amounts of ETH. On-chain data reveals that two newly created wallets, linked to Bitmine, withdrew $135.1 million worth of ETH from FalconX earlier today, signaling that major investors are once again increasing their exposure to Ethereum.

Bitmine Expands Its Ethereum Holdings

Blockchain intelligence platform Arkham reported that Bitmine’s total Ethereum holdings have risen above 3.126 million ETH, valued at approximately $12.47 billion. The company’s growing reserves now account for around 2.6% of Ethereum’s circulating supply.

Despite recent price fluctuations that briefly reduced the dollar value of its holdings, the number of ETH tokens accumulated by Bitmine has continued to rise. This pattern reflects a steady accumulation strategy designed to build long-term reserves for staking and treasury diversification.

Whale Orders Drive Market Activity

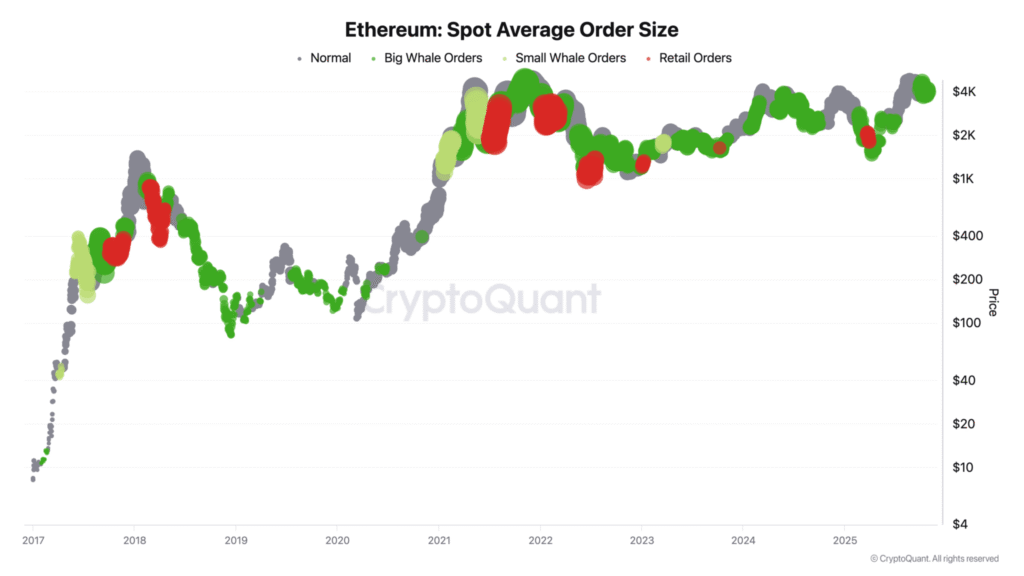

On-chain analytics platform CryptoQuant recorded an increase in average order sizes in spot markets. The data showed that large whale orders accounted for roughly 0.03% of total trade volume, with an average price of $3,986 per ETH.

These large-scale orders are concentrated near the $4,000 mark, suggesting that institutional desks and high-net-worth investors are positioning for potential upward moves. The data also indicated consistent “green clusters,” often associated with ongoing accumulation rather than short-term speculative trading.

Such whale activity was last observed during Ethereum’s consolidation phases in 2020 and mid-2023, both of which preceded major upward rallies.

Key Technical Outlook

Analyst Crypto Caesar noted that Ethereum must avoid falling back into its previous trading range to maintain its bullish structure. The weekly chart shows that ETH recently retested a key resistance zone near $4,650.

A continued move above this level could confirm a potential recovery, while failure to hold may trigger a correction toward $3,000.

At the time of writing, Ethereum trades around $3,976, consolidating below the $4,000 psychological level amid rising institutional inflows.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.