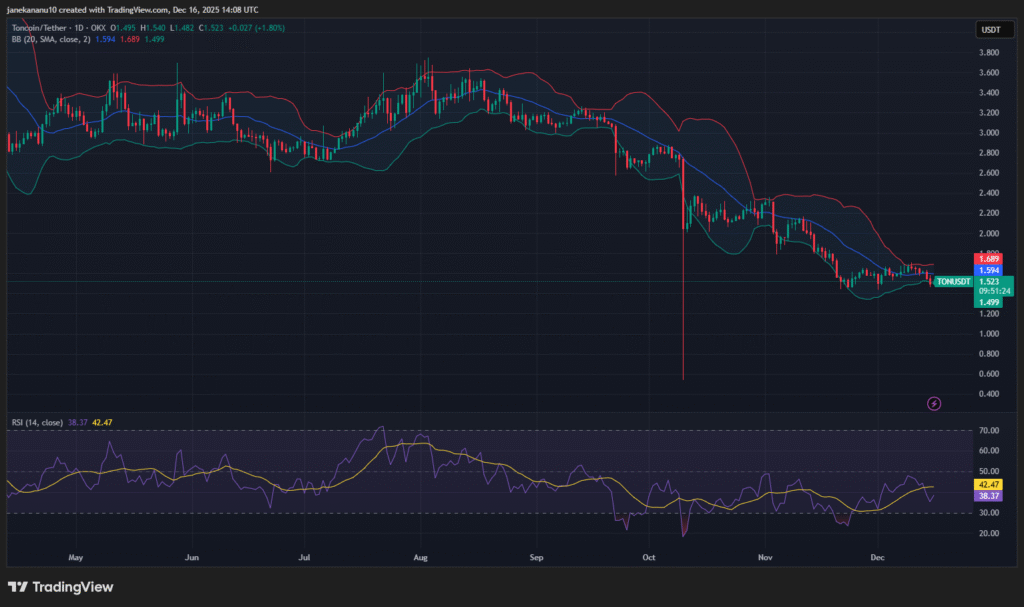

- $TON’s RSI at 38.37 signals bearish momentum, but not yet oversold.

- A breakout above the descending channel resistance could lead to $5.7.

- Traders are eyeing potential support as $TON holds near the lower Bollinger Band.

TON Price Action Faces Consolidation After Sharp Drop

The price of $TON has shown a sharp downward movement in recent trading sessions. Currently, the price hovers near the lower Bollinger Band, suggesting possible oversold conditions.

The relative strength index (RSI) sits at 38.37, indicating bearish momentum. However, it is still far from the extreme oversold zone, which is below 30.

This gives traders a mixed view of the market, as the asset could either continue its downward trend or find support and reverse.

Despite the bearish outlook, the price has entered a consolidation phase after the sharp drop. This could suggest that a reversal is possible if the price manages to hold above the lower Bollinger Band.

Short Setup and Volatility Considerations

A short setup for $TON was identified on December 13, based on the chart shared by TP.hl. The chart illustrates that the asset is approaching a 4-hour order block (OB) after an initial decline.

According to TP.hl, caution is necessary as the market shows volatility. Traders are urged not to zoom out too much, as the overall market dynamics could shift quickly, potentially leading to larger price movements.

Looking at the broader chart, $TON appears to be moving within a descending channel. This pattern shows a clear downward trend, but recent price action suggests a possible shift.

If the price manages to break above the channel’s resistance, it could lead to a surge in price toward a target of $5.7. A breakout above this level would signal a shift in market sentiment and could open the door for further upward movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.