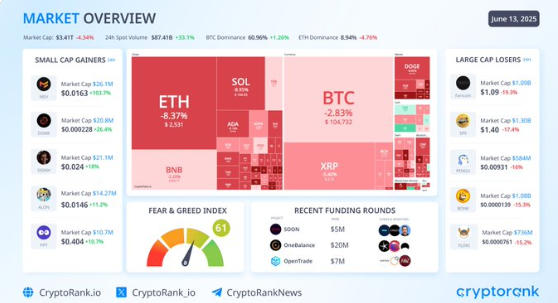

- $BTC dips to $104.7K, and $ETH decreases by 8.37%, dragging the entire crypto market cap to $3.41T.

- More than $1.15B worth of liquidations indicate the growing volatility in the market and intolerance of leverage.

- Small-cap guards such as $MEV (+103.7%) and $DOME (+26.4%) record solid profits as the rest of the market declines.

The Cryptocurrency market mimicked ALL-TIME significant losses in the last 24 hours, as Bitcoin (BTC) lost 2.83% of its value and is now trading at around $104,700. Ethereum (ETH) saw a greater loss of 8.37%, and it is hovering around $2,531. The overall market capitalization is $3.41 trillion, and it shows that the confidence of investors in the short-term volatility has reduced.

Statistics indicate that more than $1.15 billion worth of leveraged positions were closed out on the exchanges, which added more evidence to the risk-off mood. Fear & Greed Index stays high at 61, and it is in the Greed zone, even as prices are falling. The Altcoin Index, though, declined to 26 out of 100, showing reduced interest in smaller digital tokens.

Enterprise Adoption Gains Momentum Through Product Expansion

Coinbase announced it will launch the Coinbase One Card in fall 2025, offering up to 4% back in Bitcoin for every purchase. This transfer will encourage everyday use of cryptocurrencies with adoption incentive systems. The card is anticipated to promote a smooth connection with the user’s wallet and advanced spending utility.

Meanwhile, Shopify has also entered into a strategic partnership with Coinbase and Stripe to accept payment in $USDC stablecoins. The partnership will give merchants more crypto payment alternatives, allowing digital assets to bridge the divide with conventional e-commerce infrastructure. Combined, these efforts point to a wider usability and payment infrastructure focus within the industry.

Mercurity Fintech, a Nasdaq-listed firm, has also announced its plans to raise $800 million to empower its Bitcoin treasury. This funding round is an indicator of the rise in public companies becoming more exposed to BTC as a balance sheet diversification play.

Small-Cap Tokens Register Isolated Gains

Some small-cap assets stocked up in spite of the generally weak market. The biggest memory peaked MEVerse ($MEV) with a 103.7 percent gain over the last 24 hours. Everdome ($DOME) was next with a gain of 26.4 percent, abetted by a resurgence of investor interest.

Other big movers are SIGMA (18 percent), ALON (11.2 percent) and PPT (10.7 percent). These gains are notable against a background of red in most large-cap cryptocurrencies and indicate a restricted yet specific interest in high-volatility tokens.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.