- TRX is consolidating near $0.343, forming a solid support base that often precedes renewed bullish momentum.

- Declining trading volume indicates accumulation, suggesting that strong hands are positioning for the next potential rally.

- With consistent higher lows and improving technicals, TRX could break above $0.37 if buying pressure strengthens in late 2025.

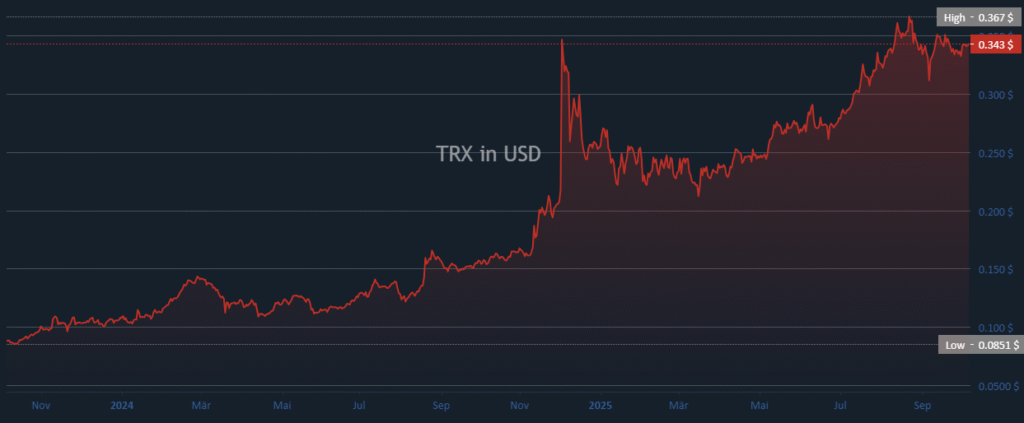

TRON (TRX) shows strong potential for renewed upward movement as the market enters a phase of stabilization and accumulation. Recent technical data and trading volume patterns indicate firm support around current levels, setting the foundation for a possible bullish continuation. The token trades near $0.343, holding steady after an extended uptrend from 2024 through late 2025.

Market Behavior and Support Formation

TRX continues to consolidate after a significant period of growth that lifted the token from $0.08 to a high of $0.367. The price now stabilizes near a key support range, reflecting a balanced market between buyers and sellers. This formation typically signals that the asset is preparing for another potential move once momentum builds.

The ongoing cooling phase in trading volume supports the likelihood of structural consolidation. Reduced volatility allows stronger hands to accumulate, while selling pressure gradually declines. Historical price data suggest similar cooling phases have preceded upward accelerations in earlier market cycles.

If this trend holds, TRX could reestablish a strong price base before testing higher resistance levels. Sustained support around $0.30 will be critical for confirming this phase. Continued stability would strengthen confidence in the token’s medium-term outlook.

Volume Dynamics and Market Outlook

The volume bubble map highlights a shift from overheated conditions to moderate trading activity. This reduction typically precedes accumulation and renewed bullish energy. Market sentiment reflects confidence that TRX may soon enter another acceleration cycle.

Source: blockchaincenter

From mid-2025 onward, TRX has displayed consistent higher lows, indicating steady structural strength. The token’s controlled recovery suggests measured buying activity and growing market participation. If renewed volume accompanies this setup, a breakout above $0.37 could follow in the coming quarter.

In summary, TRX demonstrates a resilient structure supported by stable technical indicators and firm demand zones. The price consolidation phase appears healthy, setting the stage for renewed acceleration. With sustained support and increasing participation, TRX may be preparing for its next upward move in late 2025.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto Newz does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.