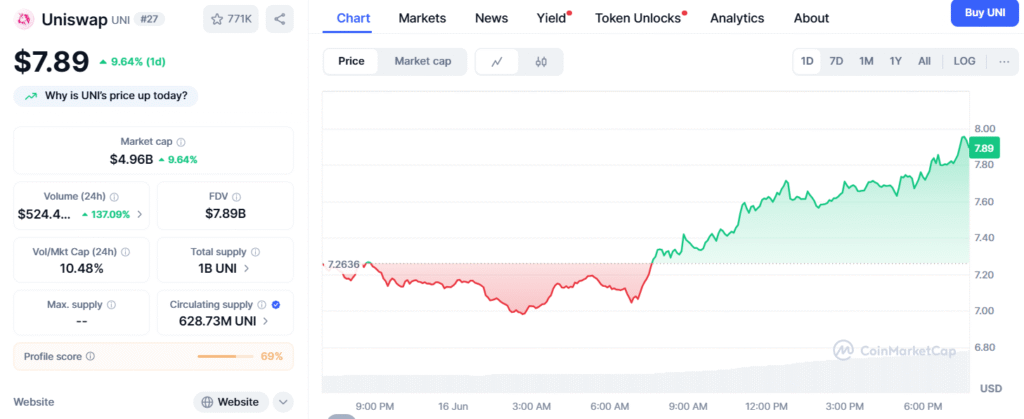

Uniswap (UNI) is once again capturing the spotlight after posting a solid 5.33% price jump, bringing its value to $7.58. This rally comes amid compelling shifts in both usage patterns and technical indicators—signaling that UNI may be gearing up for a potential breakout.

On-Chain Activity Hints at Growing Strength

Despite a 4.1% drop in active addresses, Unichain transaction volume has surged 32%, indicating that users are interacting with the protocol more frequently. This kind of divergence is often interpreted as a bullish signal, suggesting that although fewer wallets are active, those participating are making larger or more frequent moves—possibly due to new incentives or protocol upgrades.

One such catalyst is the recent rollout of UniswapX’s zero-gas limit orders, which let users execute trades without gas fees by combining on-chain and off-chain liquidity. Detailed in a post on blog.uniswap.org, this innovation could set a new standard for decentralized exchanges (DEXs), especially as gas fees remain a barrier for mainstream users.

As adoption of UniswapX increases, the demand for UNI tokens—which serve as the governance and fee-sharing utility—could rise accordingly. CoinGecko currently pegs UNI’s fully diluted valuation (FDV) at BTC 68,987.85, showing room for potential growth if protocol usage scales.

Market Behavior: Whale Caution vs. Retail Confidence

Still, it’s not all smooth sailing. Large holder netflows—a proxy for whale activity—have fallen 93% in the past month, showing reluctance among major investors. Meanwhile, resistance between $7.60 and $7.80, as shown in Binance’s liquidation heatmap, remains a short-term obstacle.

Yet retail investors seem undeterred. A 50.6% spike in exchange outflows, paired with a 19.5% drop in inflows, suggests that more UNI is being moved off exchanges—likely into cold wallets or DeFi protocols for staking. This behavior typically points to reduced sell pressure and a bullish accumulation phase.

Technical Setup Supports Gradual Climb

Data from CoinGlass shows that funding rates remain modestly positive at +0.0062%, indicating a slight long bias without an overleveraged environment. This creates a foundation for a more sustainable rally, as it lowers the risk of sharp liquidations.

Should UNI push past the $7.80 resistance zone, it could ignite a wave of short liquidations and momentum buying—potentially accelerating price action toward higher levels. But to maintain that trajectory, Uniswap must continue delivering value and keep larger investors engaged.

Conclusion: A Decisive Moment for UNI

Uniswap stands at a pivotal moment. With innovative product rollouts like zero-gas trading, rising transaction activity, and decreasing exchange supply, the fundamentals are aligning for a bullish move. But breaking resistance and restoring whale confidence will be key to turning this rally into a sustained uptrend. Investors should monitor price action around the $7.6–$7.8 zone closely.

A breakout could signal the start of a larger move. Until then, UNI remains a token to watch—especially in a market hungry for strong DeFi narratives.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.