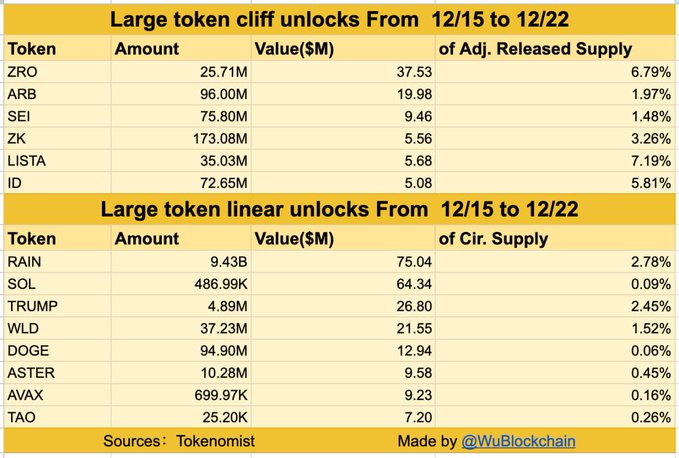

• One‑time token unlocks over $5M scheduled for six major projects.

• Linear daily unlocks above $1M include SOL, DOGE, and AVAX.

• Total token unlock value for next seven days exceeds $309M.

Large crypto token unlocks worth more than $309 million are planned in the coming week. Data from Tokenomist shows major one‑time and linear releases scheduled across several digital assets.

Upcoming One‑Time Unlocks Set This Week

Several crypto projects will release large amounts of tokens in single tranches this week. Tokenomist data shows that one‑time unlocks above $5 million are planned for ZRO, ARB, SEI, ZK, LISTA and ID.

One‑time token unlocks occur when a large block of tokens becomes free to trade. This may follow vesting schedules or project milestones. For the next seven days, these single unlocks exceed $5 million in value.

The schedule of one‑time unlocks is drawn from on‑chain data and vesting records. Token holders, traders and analysts monitor such unlocks for liquidity changes. The listed assets represent a range of networks and token types.

Linear Daily Unlocks Exceeding $1M

In addition to one‑time releases, Tokenomist data shows large linear unlocks with daily values above $1 million. Tokens on the linear unlock list include RAIN, SOL, TRUMP, WLD, DOGE, ASTER, AVAX, and TAO.

Linear unlocks refer to tokens that are released in a steady schedule over time. Each day, a portion of tokens becomes available. This can steadily increase the circulating supply.

Solana’s SOL and Dogecoin’s DOGE appear on the linear unlock list. Other tokens include Avalanche’s AVAX and Rain. Trump, WLD, ASTER, and TAO also have daily unlocks above $1 million.

“Linear unlocks release tokens each day according to a vesting plan,” Tokenomist said in its report. The schedule outlines how many tokens are released and when.

The combined value of one‑time and linear unlocks over the next week is more than $309 million. This figure is based on current market prices and the number of tokens scheduled to be released.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.