- USDC dominance retest suggests a shift toward stablecoins in the bear market.

- The retest signals a potential decline in Bitcoin prices as investors seek safety.

- USDC dominance shows a typical risk-off attitude, moving funds from Bitcoin.

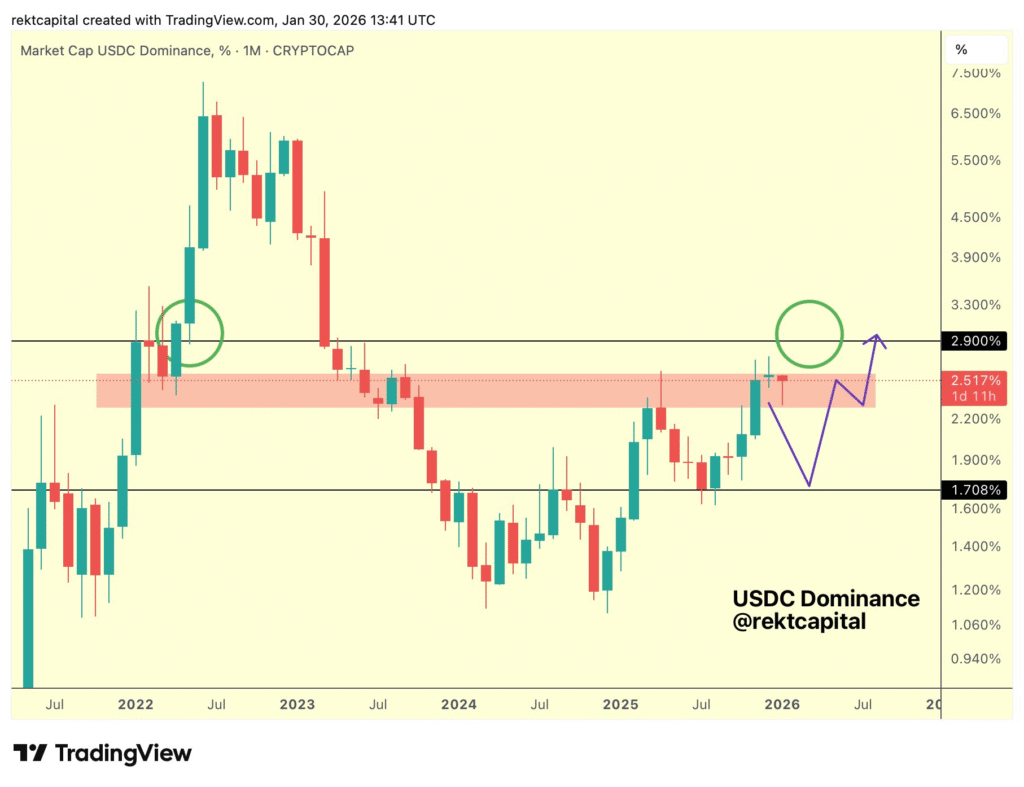

USDC dominance has shown a notable increase, signaling a potential continuation of a bearish trend in the cryptocurrency market. This shift, identified by Rekt Capital, often occurs after a 5-6 month period into bear markets, suggesting a risk-off sentiment. Historically, this pattern precedes a downturn in Bitcoin’s price as investors move their funds into stablecoins, further indicating a shift in market dynamics.

USDC Dominance Signals a Shift in Crypto Market Dynamics

The cryptocurrency market is seeing an important trend emerge as USDC dominance begins to show signs of a larger market shift. As noted in a recent analysis by Rekt Capital, USDC dominance tends to indicate a continuation of a bearish trend in the market, especially when it sees a retest of previous highs.

This pattern has emerged after 5-6 months into bear markets, suggesting that investors may rotate funds into stablecoins like USDC during these periods.

The retest of USDC dominance has historically preceded a significant pullback in Bitcoin prices. This signals a “risk-off” sentiment in the market, where investors move away from more volatile assets like Bitcoin and seek the stability of assets like USDC.

The movement is consistent with previous market cycles, which show that when investors feel uncertain, they often move their capital into stablecoins, leading to a decrease in demand for more volatile cryptocurrencies.

Bitcoin Faces Potential Decline as Investors Shift Focus to USDC

As USDC dominance increases, Bitcoin is likely to experience downward pressure. The shift toward stablecoins indicates that investors are prioritizing stability over potential gains in more volatile assets like Bitcoin.

When USDC dominance increases, it reflects a growing preference for safety in the form of stablecoins, which often sees funds being pulled from riskier investments such as Bitcoin.

The market’s reaction to this trend is often visible in Bitcoin’s price movements. As more funds are allocated to stablecoins, the demand for Bitcoin decreases, leading to a potential drop in its price.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.